ITR Filing Due Date: Latest Updates Every Taxpayer Must Know

These days, only one thing is being discussed everywhere – ITR filing due date. Filing income tax return is not just a formality, but a responsibility that every individual must fulfill. Every year lakhs of people file their tax returns, but this time the biggest concern of people is what is the ITR filing date and its deadline. Many taxpayers are still confused whether the government has given any extension this year or not.

You must have also seen on social media and in the news that ITR filing last date news and ITR news are continuously trending. Everyone has the same question – “Will I get extra time to file my return?” In this article, we will tell you about the latest income tax return news today, new notification and ITR filing due date from the income tax department which will be helpful for you.

ITR Filing Due Date: What is the biggest worry?

Every year the government fixes an official deadline which every taxpayer has to follow. If you are an individual taxpayer then you must keep in mind that missing the ITR filing last date for individual can bring penalties and interest charges for you. This time also the department has given clear guidelines for taxpayers that timely filing is the best option.

At present, the most searched question among people is the last date for filing income tax return in India. This topic is also getting highlighted a lot because every year on the last day people rush to the IT portal and face problems due to system overload. That is why experts say that you should not wait for the deadline but should file your return as soon as possible.

Income Tax Return Latest News Today and Notifications

In recent updates, the Income Tax Department has issued some new guidelines so that taxpayers can do their work easily. As per the latest income tax notification, the functionality and user experience of the portal has been improved so that people can file their returns without any technical issues.

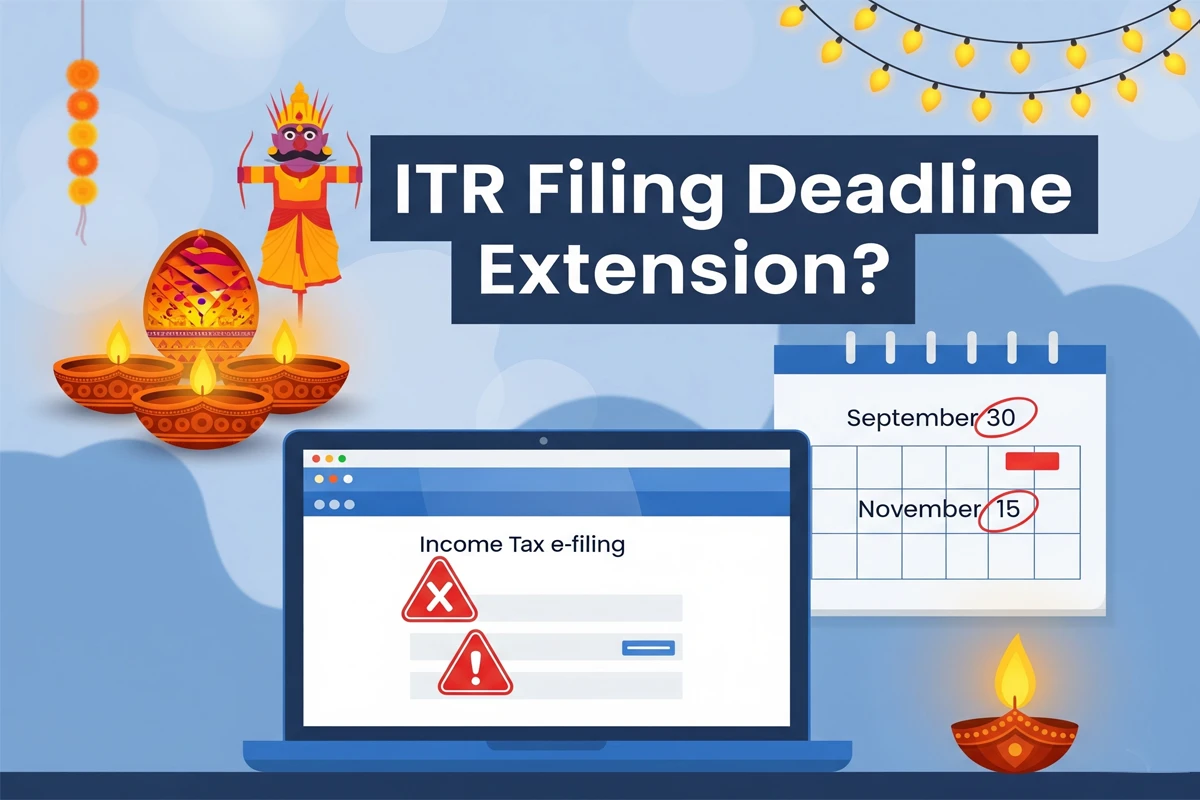

But the most important thing is that till now there is no official update on the latest news of income tax return filing due date extension. Meaning, for now, taxpayers will have to follow the existing deadline. Many news portals and finance experts are saying that there are very less chances of the government extending the deadline, so you should not take any last minute risk at all.

ITR Filing Date and Taxpayers’ Responsibility

Often people consider ITR filing date as a routine task and think that they will do it at the end moment. But the truth is that this is a serious responsibility which directly impacts your financial records and credit profile. If you file your return on time, you not only save yourself from penalties but also benefit in getting loans or financial approvals in future.

This year too there is a lot of speculation about the last date for filing returns but the truth is that the department’s stand is clear – file on time and avoid unnecessary delays. It is important for every individual to keep his financial data, Form 16 and other required documents ready so that the filing process is smooth.

Why You Should Not Wait For ITR Filing Last Date

You must have often seen that on the days of ITR filing last date news, there is heavy traffic on the IT portal and the system becomes slow. Due to this, users have to face login issues, OTP delay and technical errors. If you are a smart taxpayer then you should understand that waiting for last date for filing income tax return in India is not a good idea.

Early filing also gives you a psychological peace that you have fulfilled your legal responsibility. Apart from this, if there is any error or mismatch in your return, then you also save time to correct it.

ITR Filing Due Date and Taxpayers’ Future

Experts say that those who file their returns on time get financial benefits in the future. This is not just a compliance task, but a step that makes your financial journey secure. If you file timely, you save yourself from unnecessary penalties and late fees. Also, if you want to claim a refund, you get your refund faster by filing early.

This time also the government has made it clear that taxpayers should file their returns on the ITR filing due date and should not expect any extension. So if you are still waiting then this is the right time to get your documents ready and file your return.

Conclusion

ITR filing is an important step for every individual which cannot be ignored. Ignoring the ITR filing due date can be a big risk. It is the duty of every responsible citizen to file his return on time. Whether you are a salaried employee or self-employed, if you file your ITR before the deadline, you can secure your financial future. Today’s Income tax return latest news clearly shows that there are less chances of the deadline getting extended, so file your return without delay.

Disclaimer:

This article is for informational purposes only. Tax laws and notifications keep changing from time to time. Readers are advised to consult the official Income Tax Department website or their financial advisor before taking any final decision.

Also Read

Income Tax Portal Glitches: Why CCTAX Demands ITR Filing and Tax Audit Deadline Extension