Bajaj Finance Share Rally: GST Cut Brings Festive Season Boost

Indian stock market witnessed a positive wave on Thursday when prices of Bajaj Finance share and Bajaj Finserv both shot up. This jump has come after a big announcement by the government – GST rate cut on consumer durables. Things which were earlier under 28% GST like air conditioners, televisions above 32 inches, monitors and dishwashers, will now be subjected to 18% GST. The impact of this decision is not just on consumers but is also directly seen on financing companies like Bajaj Finance.

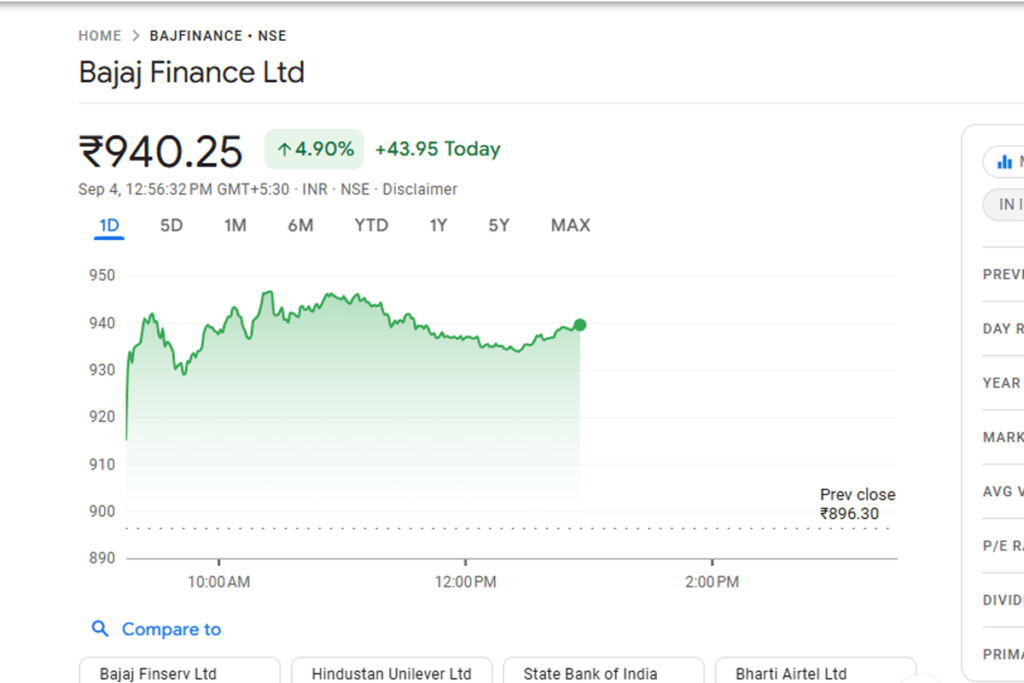

Bajaj Finance Share Price Soars After GST Cut

On Thursday, Bajaj Finance share price jumped 5.8% to Rs 948.20, while Bajaj Finserv shares closed 3.5% higher at Rs 2,034.40. Market experts say that this is not just a short-term rally but could mark the beginning of a new revival in consumer demand during the festive season.

Bajaj Finance, which is famous for its zero-cost EMI options for consumer durable financing, could benefit the most from the GST cut. When the effective purchase price of electronic goods is low, EMIs seem more affordable. This is expected to speed up loan disbursals, which will further help Bajaj Finance expand its customer base.

Bajaj Finance Share News: Analysts’ Positive Outlook

Global brokerage Jefferies wrote in its report that the direct impact of GST cut will be most on air conditioners and large-screen televisions. Retailers had a lot of unsold stock which can now be cleared soon. The revival of demand can become a strong catalyst for the industry, and its direct impact is also visible in Bajaj Finance share news.

It will have limited impact on dishwashers as their market share is small. But overall consumer sentiment will have a positive wave, which will indirectly support every consumer durable segment. This is the reason why investors have now become more optimistic about Bajaj Finance share price target 2025.

Bajaj Finance Share Split and Future Outlook

Another discussion is going on in the market and that is about Bajaj Finance share split. Whenever a share split happens, it becomes easier for retail investors to take entry. This also increases the chances of increasing liquidity. If Bajaj Finance split date is announced going forward, it will make the company’s stock more investor-friendly.

In the long term, experts say that GST cut and festive demand together will strengthen Bajaj Finance’s growth trajectory. Zero-cost EMI financing and cross-selling opportunities give the company a sustainable edge. This is also a big advantage for parent company Bajaj Finserv as it can generate extra revenue through insurance and asset management.

Bajaj Finance Share Price Target 2025

According to analysts, if festive season demand grows on expected lines, then Bajaj Finance share price target 2025 can become even stronger. EMI affordability will expand the loan book, which will support long-term profitability. Bajaj Finance has always built its business model with a consumer-centric approach, and the GST cut has added a new growth booster to it.

Bajaj Finance Share News Today: Festive Cheer Ahead

Today’s Bajaj Finance share news today says that the demand for consumer durables in the market may reach a new height. This can become a golden opportunity for investors, especially for those who want to create long-term value. Both Bajaj Finance and Bajaj Finserv are preparing to accelerate growth by diversifying their revenue streams during the festive season.

This GST cut is a relief for Indian households, as now they will have to spend less on purchasing large electronics and appliances. And when consumers are happy, naturally financing companies also prosper. Bajaj Finance share rally is proof that the market has positively embraced this development.

Disclaimer

This article is for informational purposes only. The views and analysis given in it are not investment advice. Before taking any financial decision, definitely consult your financial advisor.

Also Read

CG Power Share Price Jumps 2.14% | Strong Financial Growth & Investor Outlook