“This article expresses my personal analysis based on publicly available financial data and market reports.”

The stock market sees a flurry of companies entering the market every day, catering to their respective segments. In this series, another company is poised to list and has launched its IPO. Excelsoft Technologies Ltd., a company that helps students and professionals shape learning and assessments worldwide, also assists governments in conducting exams. Excelsoft Technologies Ltd. is aiming to reach out to the public and build trust through its 2025 IPO. As bidding heats up and rumours spread in the grey market, many small investors are asking: Is it worth it? Let’s understand this in layman’s terms.

Excelsoft Technologies IPO – Basic Details You Should Know

- Excelsoft’s IPO opens on 19 November 2025 and closes on 21 November 2025.

- The price band is set at ₹114-120 per share.

- The total issue size: approx ₹500 crore, of which roughly ₹180 crore is a fresh issue and around ₹320 crore is an offer-for-sale (OFS).

- Minimum lot size for retail investors: 125 shares.

- Listing is expected on the National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE) around 26 November 2025.

Also Read Motilal Oswal Clarifies After Kaynes Tech Share Sale Draws Attention

Why Excelsoft’s Business Seems Attractive

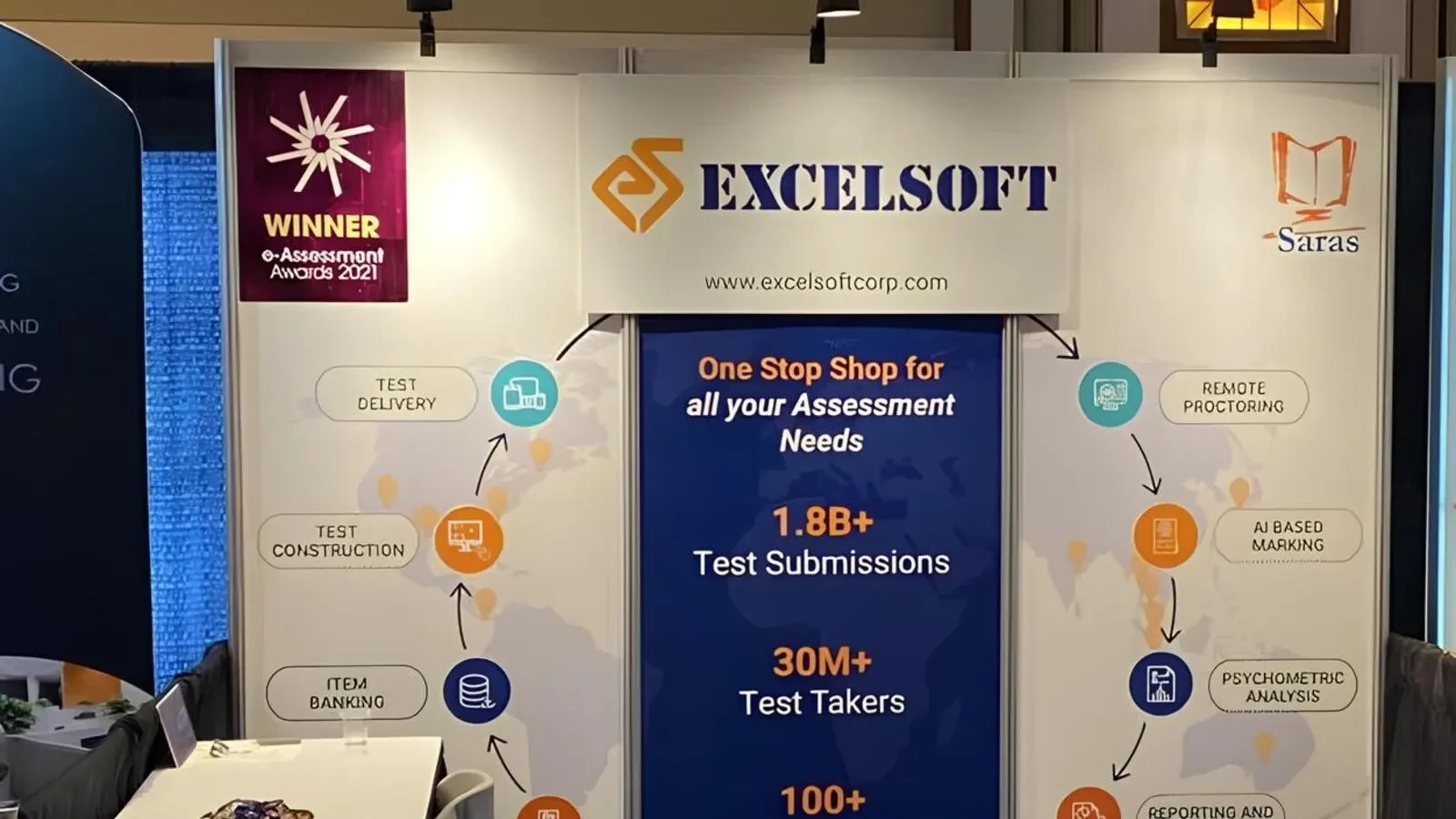

Excelsoft is a niche player in the EdTech SaaS (software-as-a-service) space, focusing on learning and assessment platforms. They claim over 20 years of operations and a global clientele including education boards, universities and corporations.

In an era where remote learning, upskilling and online assessments are booming (especially after 2020), a company like this could ride strong secular trends. Personally, I feel that investing in future-oriented sectors is emotionally reassuring — you’re not just buying shares, you’re buying into a narrative of learning and growth.

What the Market Is Saying – Subscriptions & Grey Market Premium (GMP)

By Day 2 of bidding, the IPO had been subscribed 6.89 times overall. Retail portion about 5.92 times, NII portion ~18.20×.

Grey market premium (GMP) is hovering around ₹14-₹15, suggesting a possible listing price in the ballpark of ₹134-₹135 if sentiment holds.

All this shows strong investor appetite. But remember: GMP is not guaranteed, it’s an informal indicator.

The Valuation & Risk Factors You Shouldn’t Ignore

- Valuation looks rich: reportedly around 35-39 times FY25 earnings estimates and ~57× for annualised Q1 FY26 numbers.

- One big risk: According to Mint, heavy customer concentration. Around 59% of revenue comes from a single large group (Pearson Education, Inc.) — that’s a vulnerability.

- Another risk: though the market is promising, competition in EdTech/SaaS is fierce, and execution must be flawless for growth to be sustained.

- In my view, it’s not a no-go, but expectation management is critical. Don’t go in thinking guaranteed huge listing pop.

Also Read Capillary Technologies IPO Lists at ₹571.90 — Soft Start for SaaS Firm

My Verdict – Should You Apply for Excelsoft Technologies IPO?

If you are an investor with a moderate risk appetite, believe in the EdTech/SaaS story and are comfortable with a fair valuation — yes, you could consider applying.

But if you are seeking a low-risk, bargain-valuation IPO purely for short-term listing gains, this might not be ideal.

I personally lean toward subscribing — I like the long-term story of digital assessments and learning platforms — but I would keep the size moderate and have a clear exit strategy.

Conclusion

The Excelsoft Technologies IPO offers a compelling story in a growth sector and has sparked strong demand. Still, rich valuation and customer dependence are headwinds. If you’re buying with conviction and a long-term view, it could be a smart move. If you’re chasing quick jumps, maybe wait and watch. For me, stepping in feels like betting on the future of learning — and that’s something I find exciting.

FAQs About Excelsoft Technologies IPO

1. What is the Excelsoft Technologies IPO?

Ans.: Excelsoft Technologies Ltd is a global vertical SaaS company focused on learning and assessment solutions. The company launched a ₹500 crore IPO in November 2025 to raise fresh capital and provide an offer-for-sale by existing shareholders.

2. What are the Excelsoft IPO dates and price band?

Ans.: The IPO opened for subscription from November 19, 2025 and closed on November 21, 2025. The price band was set at ₹114 to ₹120 per share.

3. How big is the issue and what is the lot size?

Ans.: The total issue size is about ₹500 crore, comprising a fresh issue plus an offer-for-sale. The minimum retail lot is 125 shares.

4. What is the current grey market premium (GMP) and what does it mean?

Ans.: Informal GMP estimates were reporting around ₹15–₹20 during the subscription window, which market players use to gauge likely listing sentiment. Remember, GMP is unofficial and can change fast.

5. How was investor demand? Was the IPO oversubscribed?

Ans.: Yes — the IPO attracted strong demand. By Day 2 it was several times subscribed (reports indicated multiple-times oversubscription across retail and NII categories), showing healthy investor interest.

Also Read TCS secures $1 B from TPG – game-changer in data-centre world

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : Mint & INDMoney - Excelsoft Technologies IPO Review

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style blends market insight with a relatable human voice — making complex data simple for everyday investors.