Global Markets Today: Massive Rally in Asian, European, and US Stocks – What’s the Big Reason?

This morning began on a positive note as Global Markets Today offered investors new hope. From Asia to Europe and Wall Street, stock markets were seen in the green zone everywhere, which clearly shows that the sentiment of investors is still quite positive. This rally was not limited to just one region, but optimism towards the technology sector, international trade and the policy stance of central banks played a big role in taking global equities up.

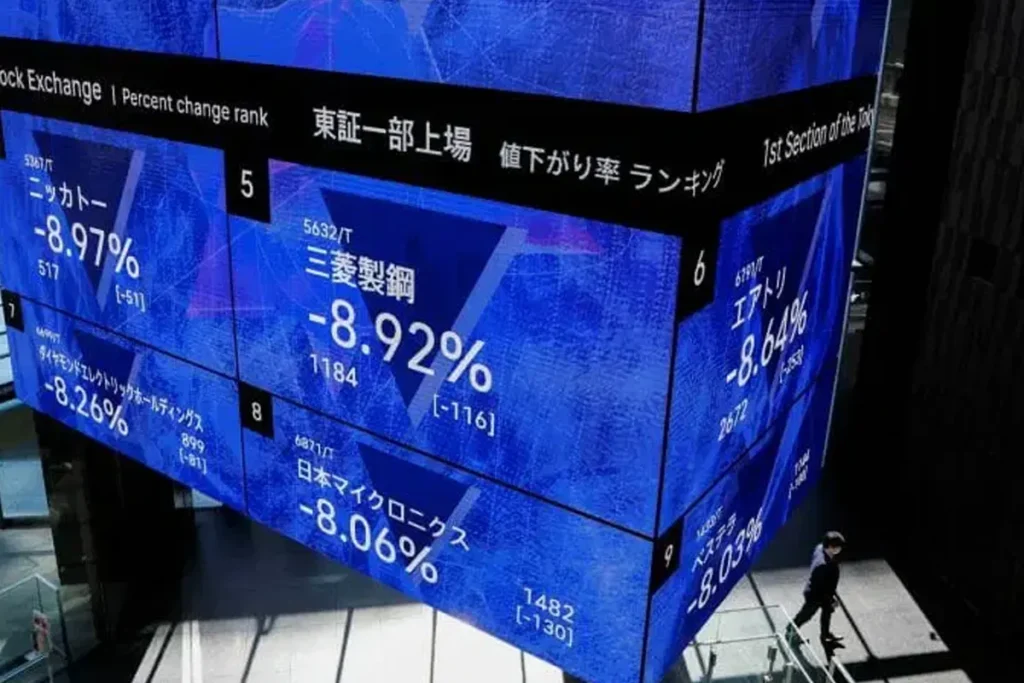

Global Markets Today: Kospi and Nikkei’s Massive Jump

Asian markets were the first to rally in Thursday’s session. South Korea’s Kospi index jumped more than 2%, driven by shares of Samsung Electronics and SK Hynix. Both companies had announced a partnership with OpenAI a day earlier, in which their memory chips will be used for OpenAI’s Stargate data centers. This news created tremendous demand for technology and semiconductor stocks.

Japan’s Nikkei 225 also gained positive momentum and grew around 1%. Hong Kong’s Hang Seng and Australia’s S&P/ASX 200 also traded with gains. Singapore’s Straits Times Index also opened in the green. Only China’s Shanghai Composite and Shenzhen Composite remained closed due to a holiday.

Macro data from Asia provided support

The rally in Asian markets was supported by fresh data from South Korea and Australia. Based on statistics from South Korea’s stats agency, inflation rose from 1.7% to 2.1% in September. At the same time, the Australian Bureau of Statistics released that the trade surplus of the country amounted to a record 1.82 billion Australian dollars in August. Both reports created an additional boost for the markets. Both data points brought a mixed but overall positive sentiment for investors.

Trading between the dollar and the yen remained flat, and there was no major movement in the currency market.

Global Markets Today: New Records on Wall Street

Not only Asia, but Wall Street also set new records last night. US markets were no slouch either. S&P 500, Dow Jones Industrial Average, and Nasdaq Index all closed at record highs. S&P 500 rose 22.74 points, the Dow Jones Industrial Average also closed in green, and the Nasdaq Composite registered the biggest rally to climb 95.15 points to record highs.

This rally was driven by soft U.S. economic data. Weak job market signals led investors to expect the Federal Reserve to cut interest rates twice this year. Additionally, investors bet on the U.S. economy. Ignoring the short-term risk of a government shutdown, the government focused on policy easing.

European markets also turned green.

European bourses also followed this positive global momentum. Looking at Europe, Germany’s DAX Index closed with a gain of 232 points, where industrial and auto stocks gave a strong performance. London’s FTSE 100 and France’s CAC 40 also closed in the green zone with gains of around 1%.

Cooling signals of Eurozone inflation gave investors further confidence. This raised expectations that the European Central Bank might now stop aggressive tightening. This became a major sentiment booster, helping European equities rally.

Global Markets Today Outlook: What’s the next step?

Experts say that this upswing in global markets today is a sign of an improving risk appetite. Investors believe that central bank policies may now be somewhat accommodative, the global economy remains resilient, and the technology sector still shows strong growth potential. Energy stocks are also contributing, with everyone watching the trajectory of crude oil prices.

But experts are also predicting that not everything is that simple. U.S.-China tensions in trade, geopolitical issues, and crude oil price uncertainty are still risk factors for the markets. That is, it’s not possible to tell how long the rally will last.

Conclusion

Today was a breath of fresh air for global investors. Indices from Asia to Europe and Wall Street simultaneously showed positive momentum, reflecting a healthy and optimistic market sentiment. Global Markets Today showed that when technology and macro data simultaneously deliver positive news, a massive rally could occur in global equities. It remains to be seen how long this optimism lasts and what impact central banks and geopolitics will have in the coming weeks.

Disclaimer:

The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Also Read

First Brands Bankruptcy Shakes Wall Street | Debt Investigation & Rescue Financing Drama