Hindustan Aeronautics Shares Rise: What is the story behind it?

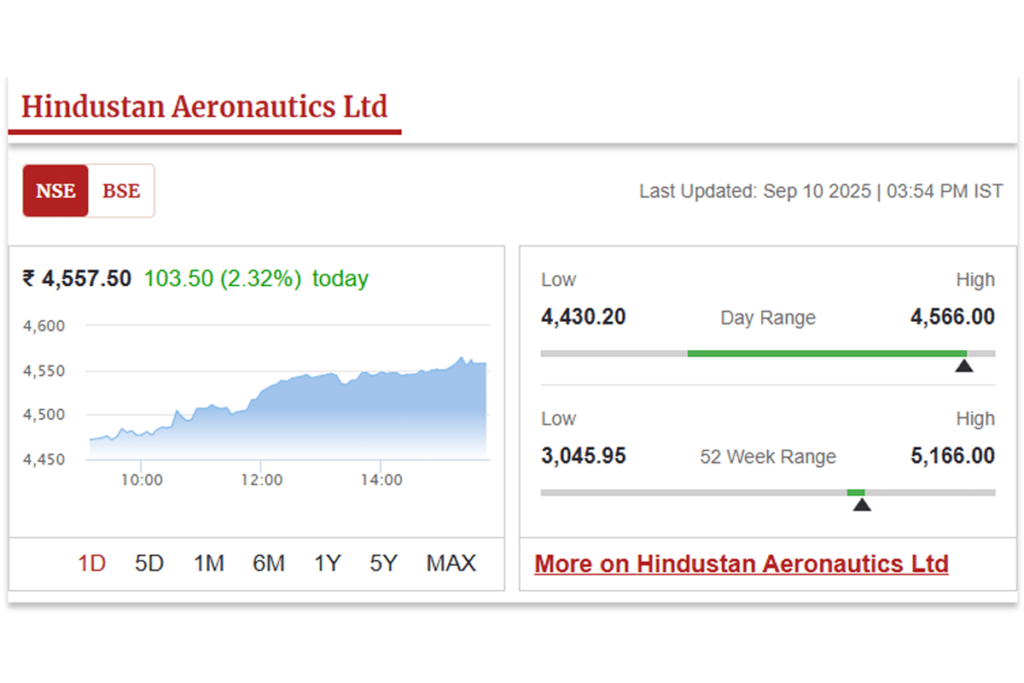

Today once again Hindustan Aeronautics shares grabbed everyone’s attention in the stock market. On 10 September 2025, in the Wednesday trading session, HAL shares were seen buzzing with a jump of almost 2%. By around 2:30 PM, Hindustan Aeronautics shares were trading at ₹4,542 per share, which was 1.99% up, while in comparison the BSE Sensex was only 0.31% higher, around 81,350.68 levels. This movement was not a normal uptick, but there was a strong reason behind it which can change the future of space and defense sector.

Why did Hindustan Aeronautics Shares show stagnation?

The biggest factor that lifted Hindustan Aeronautics shares in today’s session was a technology transfer agreement that HAL signed with Indian National Space Promotion and Authorisation Centre (IN-SPACe), NewSpace India Limited (NSIL) and Indian Space Research Organisation (ISRO). This agreement was signed in Bengaluru and its focus is Small Satellite Launch Vehicle (SSLV).

SSLV is a three-stage rocket that has the capability to launch satellites weighing up to 500 kg into Low Earth Orbit (LEO). This deal is a milestone for HAL as through this the company will absorb SSLV technology in the next 2 years and will produce it for 10 years after that.

Hindustan Aeronautics Shares and SSLV Connection

Under this agreement, HAL has been given a non-exclusive, non-transferable licence which includes design, manufacturing, quality control, integration, launch operations and post-flight analysis. This licence comes with training and technical support so that HAL can further strengthen its production and innovation capacity.

HAL CMD D K Sunil also said, “HAL will work closely with IN-SPACe, ISRO and NSIL to indigenise and commercialise SSLV technology. This initiative will not only ensure high-quality satellite launch services, but will also create new opportunities for India’s MSMEs, start-ups and industrial ecosystem.”

How will Hindustan Aeronautics Shares benefit in the long term?

The most important aspect is that HAL will now enter the mass production phase and cater to domestic as well as global demand. The pact gives HAL the opportunity to create a new space vertical where it will build, own and operate launch vehicles. This will lead to HAL’s transition from a component supplier to an end-to-end launch service provider.

This step gives HAL a strong positioning in the rapidly growing small satellite market. For investors, this means that Hindustan Aeronautics shares show a futuristic and stable growth potential, which can add further value in the coming years.

Hindustan Aeronautics’ Legacy and Market Position

If we talk about the legacy of the company, Hindustan Aeronautics Limited was established in 1940 and has its headquarters in Bangalore. It is India’s largest aerospace and defense company, and also has an established name globally. HAL’s operations cover everything from manufacturing of aircraft, helicopters and their components to design, development and upgrades.

Some of the company’s famous products include the Dhruv advanced light helicopter, Tejas light combat aircraft and the Hindustan Ambassador car. HAL also works in the repair and overhaul of aircraft and helicopters. Along with this, the company also produces crucial satellite structures.

Because of this strong legacy and technology advancement, HAL is today a trusted name and its shares have become a long-term asset for investors. As per the last update, the market capitalization of HAL was ₹3,03,757.61 crore, which clearly shows its market strength.

Hindustan Aeronautics Shares: Investor Sentiment and Future Outlook

Market experts believe that this deal is not just a short-term push, but a long-term growth driver that can take HAL into a new orbit. The demand for small satellite launches is continuously growing at the global level, and HAL now has the capability to cater to that demand.

Due to this, the trust and confidence of investors on Hindustan Aeronautics shares seems to be getting stronger. Along with the momentum, a positive sentiment is clearly reflecting in the market and analysts feel that HAL can become a strong performer for its investors in the coming quarters as well.

Disclaimer:

This article is for informational purposes only. It is not any kind of financial or investment advice. Always seek the advice of your financial advisor before investing in the stock market.

Also Read

Oracle Earnings Report: AI-Fueled Cloud Boom Pushes Oracle Stock Earnings to $144 Billion