ITR Filing Deadline Extension Request: Festive Season, Portal Glitches and New ICAI Format Become Trouble

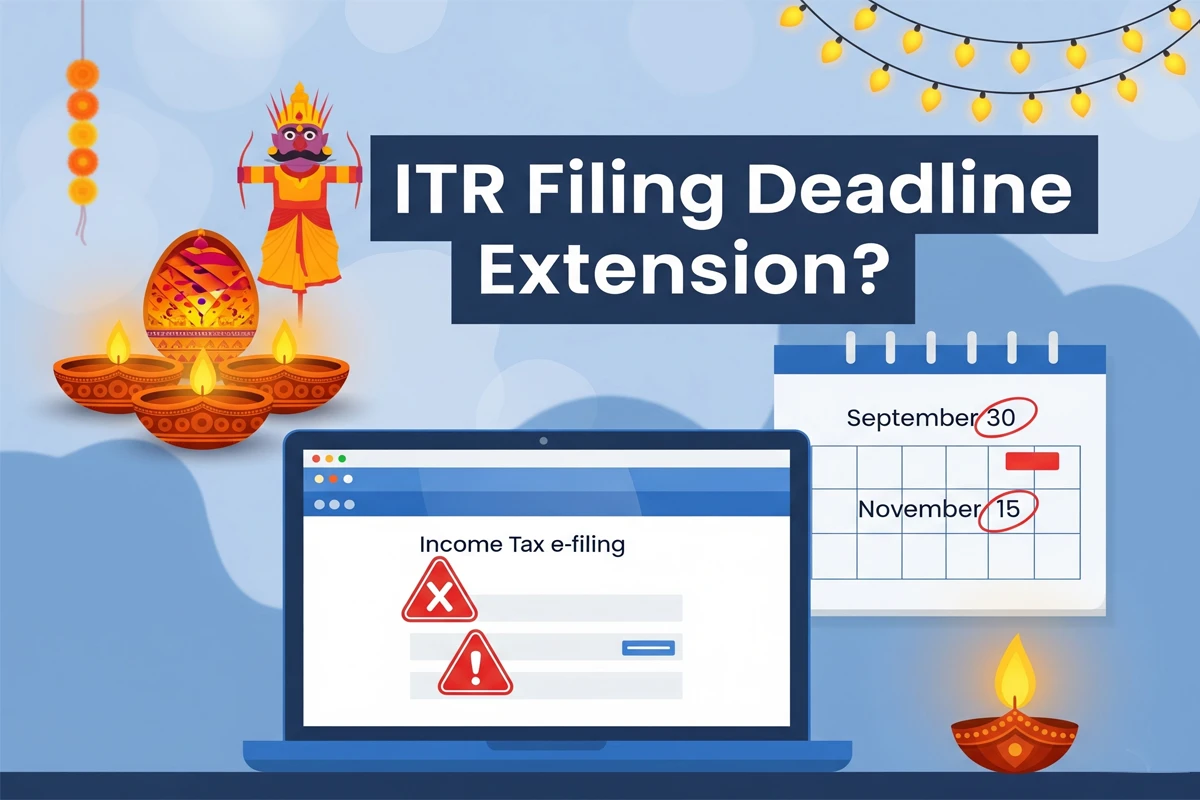

Tax season is always stressful, but this year taxpayers and professionals have to face even more challenges. Now a big demand is arising regarding Income tax return filing due date 2025. Rajasthan Tax Consultant’s Association (RTCA) has sent a representation to the Ministry of Finance and CBDT requesting that the ITR filing deadline be extended. The major reasons behind this are—Income Tax portal glitches, ICAI’s new format for non-corporates and also the festive season of Navratri, Dussehra and Diwali.

Why RTCA is Asking for ITR Filing Deadline Extension?

Regarding ITR filing due date, RTCA says that delay in release of audit forms and technical glitches are directly affecting taxpayers. When return forms and utility are not released on time, professionals do not have proper time to prepare reports. Some forms have not been released yet which is a big concern.

Apart from this, the revised format introduced by ICAI for non-corporate entities has created further complexities. Understanding and implementing new reporting requirements for non-corporate entities is very time-consuming for professionals.

And most importantly, this entire process is happening in the middle of the festive season. India has continuous festivals from August to November—big festivals like Navratri, Dussehra and Diwali shift the focus of businesses from compliance to sales. This makes it difficult to prepare statutory audits and reports timely.

ITR Filing Deadline and Current Situation in India

If we look at the deadline dates, the last date for filing ITR for individuals whose accounts are not under audit was earlier 31st July, which has now been extended to 15th September 2025. But for taxpayers who are under audit, the deadline for tax audit is still 30th September and the last date for ITR filing is 31st October.

Associations like RTCA, CCATAX and GCCI say that if the deadline for individuals has been extended, then similar relief should be given to audited taxpayers as well. Earlier there used to be a gap of 2 months between the filing date of non-audited and audited assessees, but now that time gap has been reduced which creates additional burden for professionals.

Concern of Chartered Accountants and Professionals

Chartered Accountant Ratan Goyal, President of RTCA, while speaking to ET Wealth Online said:

“In light of uncertain circumstances and the need for additional time to ensure thorough preparation and compliance of provisions of Income Tax Act, 1961, we respectfully request that the due date be extended so that both taxpayers and professionals can make timely and accurate submissions.”

He emphasised that if the ITR filing deadline is not extended now, many taxpayers will be subjected to unnecessary penalties. It is not just a matter of compliance, but also a question of fairness and understanding practical challenges.

What was said in the representation of RTCA?

RTCA has mentioned these clear points in its representation dated September 1, 2025. They said:

- Delay in release of ITR utilities and audit forms has badly impacted the preparation process.

- Portal glitches have made it impossible to upload and file reports smoothly.

- ICAI’s newly revised format has made compliance even tougher for non-corporate entities.

- During festivals like Navratri and Diwali, the focus shifts to business sales, which leads to delay in statutory compliance.

- The deadlines for non-audit assessees have already been extended, but there is no relaxation for audit cases yet.

RTCA has requested that both ITR filing deadline (for audit assessees) and Tax Audit Report submission date be extended to 15th November 2025.

Why ITR Filing Deadline Extension is Crucial

This demand is not just for the convenience of professionals but is also important for taxpayers. If the deadlines are not extended, thousands of businesses will face penalties which could have been avoided. Maintaining proper compliance amidst festive season and technical issues is a real struggle.

A practical and empathetic approach is to give everyone a fair chance by extending the deadline. If the government extends the last date for ITR filing to November 15, this step will not only provide relief to professionals but will also increase the confidence of taxpayers.

Final Words on ITR Filing Deadline

Income tax return filing date 2025 is still a heated topic and the pressure of associations is continuously increasing. While non-audit assessees have got relief, there is no clarity yet for audited taxpayers. RTCA, CCATAX and GCCI have jointly demanded that the ITR filing deadline be extended to 15th November. Now it remains to be seen how the Ministry of Finance and CBDT consider this request.

Disclaimer:

This article is for informational purposes only. The information given here is not a substitute for any professional tax advice. Readers should take the final decision only after consulting their Chartered Accountant or financial advisor.

Also Read

Vikran Engineering Share Price Live: IPO Listing, GMP & Market Updates