“This article expresses my personal analysis based on publicly available financial data and market reports.”

Vedanta Share Price Sees Uptick After Tribunal Gives Demerger Green Light

When the markets opened on Tuesday, December 16, 2025, something felt different in the Mumbai trading pits. Traders weren’t just watching numbers — they were watching history. The long-awaited corporate makeover of Vedanta Limited finally got a decisive legal nod. This wasn’t just another boardroom fight — it was a major turning point for one of India’s biggest conglomerates.

In simple terms: **Vedanta’s National Company Law Tribunal (NCLT) approval sparked real movement in the stock market — especially the Vedanta share price.

Let’s unpack why this matters — and more importantly, what it could mean for ordinary investors watching their portfolios closely.

Why Vedanta’s Demerger Is a Big Deal

Vedanta’s business is huge — spanning oil, metals, aluminium, power and more. But that size has also been a burden. In 2023, the company announced a bold plan: split its sprawling empire into five independently listed companies to unlock better focus and value for shareholders.

Think about that like this — instead of one big slow-moving giant, you now have five nimble companies, each able to chase its own growth path. It’s similar to how a family might split a big property into smaller plots so each sibling can build their dream home. That’s the corporate logic here. Real-world, human-level strategy.

But here’s the catch: regulators, government departments, creditors — everyone needed to sign off on this plan. And it took years.

Also Read KSH International IPO Opens: GMP, Details & Key Highlights

“Vedanta Share Price” Reacts — What Happened on the Markets?

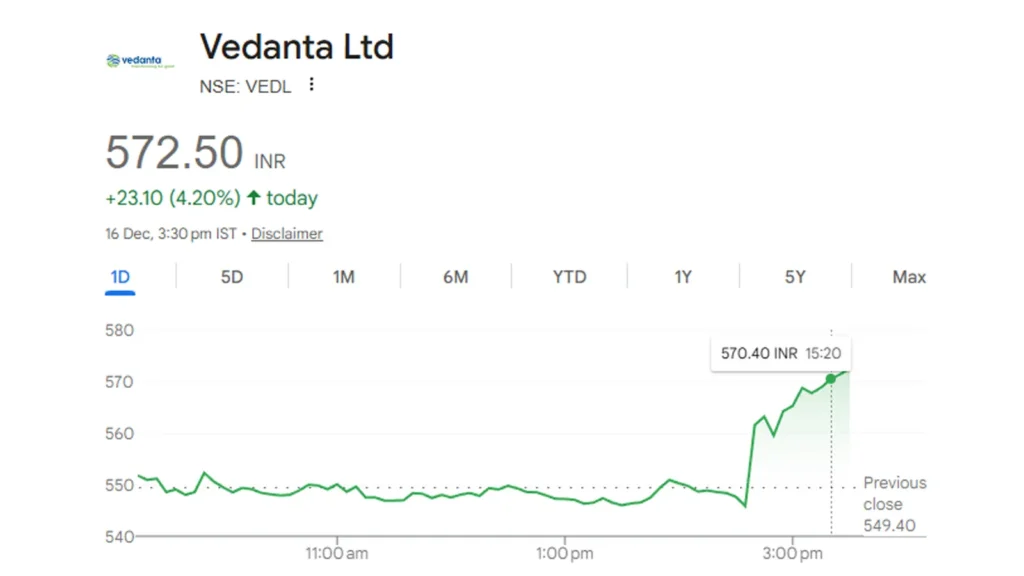

The moment NCLT said “yes,” markets erupted — Vedanta’s share price jumped significantly. Traders saw this as proof that old obstacles are finally clearing. The immediate reaction was a rise of nearly 3.7%, and in some reports, even above 4%, reaching a 52-week high.

If you are someone who watches the stock tickers every morning, this kind of movement isn’t insignificant. It tells you confidence is returning, and investors believe the company’s restructuring will ultimately unlock value.

Real people — investors, traders, small shareholders — saw this as a breath of fresh air after months of uncertainty.

Real-World Challenges Inside the Numbers

Before the tribunal nod, there were bumps on the road.

Government agencies had raised concerns about Vedanta’s asset disclosures and whether splitting the company might make it harder for the state to collect dues.

At one point, these objections even caused the Vedanta share price to dip because investors weren’t sure what would happen next.

That’s a very human reaction — when people feel uncertain, especially about their hard-earned money, markets become emotional. This tug-of-war between courts, regulators and markets created plenty of stress for investors watching the stock roller-coaster.

But with the NCLT now on board, at least one major doubt has been cleared.

What This Means for Ordinary Investors

If you’re a retail investor, you might be asking: what’s next?

Here’s what people who follow Vedanta closely are thinking:

- Potential Growth Ahead: Each of the five companies could attract investors specifically interested in that sector — say, aluminium or power. That can lift valuations over time.

- More Transparency: Smaller, more focused companies often make it easier to see what’s happening in operations — and markets tend to reward clarity.

- Risk Still Exists: The split isn’t complete until March 2026. That means there’s still work to do and some legal or financial risks that could come up. Patience is still key

In other words, this isn’t a guaranteed gold mine — but investors who stayed nervous may now breathe a bit easier.

Also Read ICICI Prudential AMC IPO: GMP, Subscription & Listing Buzz

What Experts Are Saying

According to Reuters, market analysts are already discussing how this strategic transformation could set a trend in India’s corporate world.

Some believe that smarter, leaner companies often attract better capital and enjoy stronger long-term growth prospects.

Others remind us that stock prices aren’t just numbers — they reflect confidence — and this legal win restored some of that in Vedanta’s corner.

When good news meets investor hope — that’s when you often see share prices move, just like this time.

Conclusion

Seeing the Vedanta share price bounce and trade at 52-week highs doesn’t just tell us numbers went up. It tells a deeper story — of patience, pressure and relief.

As someone who watches markets and cares about regular investors, my honest take is this: today’s rally is emotional as much as rational. It’s hoped that a clearer corporate future is nearer than yesterday.

But let’s remember — success isn’t guaranteed until the restructuring completes. Still, for now, this feels like vindication for investors who stayed the course.

And that’s something you can feel, not just calculate.

FAQs About Vedanta Share Price

1. Why did Vedanta share price rise after the demerger approval?

Ans.: The market welcomed the NCLT’s approval because it removes a major uncertainty. Investors believe splitting Vedanta into focused businesses can unlock better value and transparency.

2. What exactly is Vedanta’s demerger plan?

Ans.: Vedanta plans to split its operations into five separate listed companies, each focused on a specific sector like metals, oil & gas, or power.

3. Is this demerger good for long-term investors?

Ans.: Many experts think it can be positive over time, as focused companies often perform better. Still, investors should watch execution closely before making long-term bets.

4. When will Vedanta’s demerger be completed?

Ans.: The company is targeting completion by March 2026, subject to final approvals and procedural steps.

5. Can vedanta share price remain volatile in the coming months?

Ans.: Yes. While sentiment is positive, share prices may fluctuate as investors track progress, timelines, and broader market conditions.

Also Read Corona Remedies IPO Lists at 38% Premium: Investor Gains 2025

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : Reuters & The Economic Times - Vedanta Share Price

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style seamlessly blends market insight with a relatable human voice, making complex data accessible to everyday investors.