“This article expresses my personal analysis based on publicly available financial data and market reports.”

Gold Price Today, Silver Rate Today: What’s Driving the Market on December 30, 2025?

Gold and silver prices are back in the spotlight as Indians close the year with mixed emotions—hope, caution, and a constant eye on inflation. On December 30, 2025, gold prices on MCX showed mild fluctuations, while silver remained volatile, reflecting global cues and domestic demand patterns.

For investors, jewellers, and families planning weddings in early 2026, today’s gold and silver rates are more than just numbers—they signal where money feels safest right now.

Gold Price Today in India: Why the Yellow Metal Feels “Steady but Tense”

Gold prices today are trading in a narrow range, showing resilience despite global uncertainty. The market feels calm on the surface, but tension runs underneath.

Here’s why gold is holding firm:

- Global investors remain cautious ahead of 2026 economic projections

- Central bank buying continues to support long-term gold demand

- Rupee movement against the dollar is influencing import costs

In cities like Delhi, Mumbai, and Chennai, the prices of 24-carat and 22-carat gold are seeing only marginal changes. This stability is giving buyers confidence, especially those planning jewellery purchases rather than short-term trading.

Also Read Hindustan Copper Shares Surge 50% in 7 Days: Why in 2025

24 Carat vs 22 Carat Gold: What Buyers Are Choosing in 2025

One clear trend in 2025 is the growing preference for 22-carat gold over 24-carat.

Why?

- 22-carat gold offers better durability for daily-wear jewellery

- Making charges is comparatively manageable

- Price sensitivity among middle-class buyers is rising

Many jewellers say customers are no longer chasing purity alone. Practical value now matters just as much.

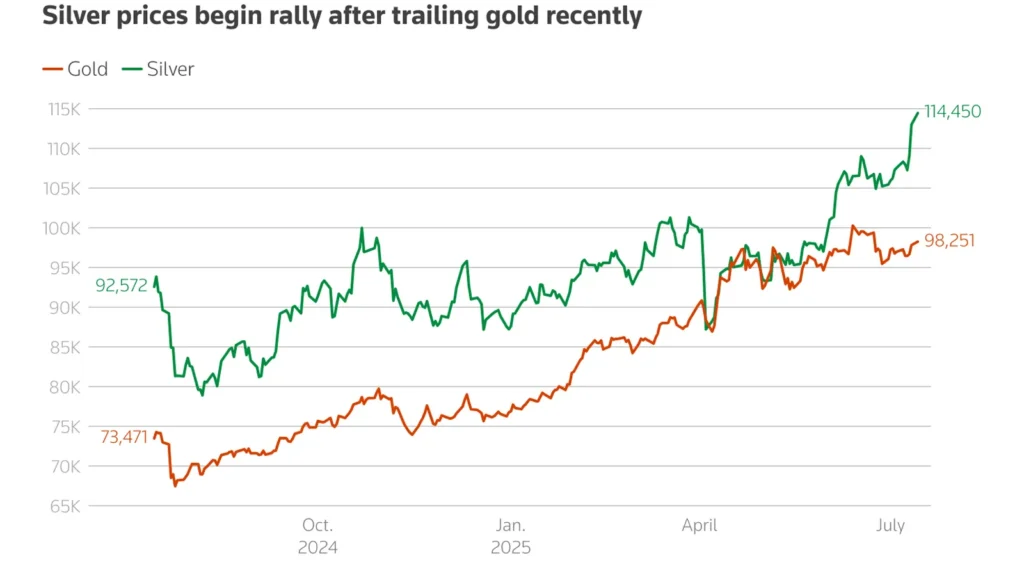

Silver Rate Today on MCX: Volatile but Full of Opportunity

Silver prices today are showing sharper swings compared to gold. On MCX, silver is reacting quickly to global commodity signals and industrial demand.

Silver’s story in 2025 is different:

- Green energy and solar panel demand are boosting industrial use

- Traders see silver as “high-risk, high-reward.”

- Retail investors are slowly warming up to silver ETFs

Unlike gold, silver doesn’t promise emotional comfort—but it does offer excitement for those who understand volatility.

Global Cues: How COMEX and the Dollar Are Shaping Prices

International markets are quietly steering Indian bullion prices. Movements on COMEX, combined with US dollar strength, are setting the tone.

Key global factors at play:

- Interest rate expectations for early 2026

- US economic data and inflation signals

- Safe-haven demand amid geopolitical uncertainty

Even small global changes are quickly reflected in Indian markets, especially on MCX.

City-Wise Gold Rates: Why Prices Differ Across India

Many readers wonder why gold prices vary from city to city. The answer lies in local taxes, logistics, and demand.

For example:

- Metro cities often see slightly higher rates due to stronger demand

- Southern cities like Chennai traditionally have higher gold consumption

- Festive and wedding seasons impact local premiums

When checking gold prices today, city-wise rates are always a consideration.

Should You Buy Gold or Silver Right Now? A Real-World View

From a practical perspective, this market isn’t screaming “buy aggressively” or “sell everything.” It’s whispering something more balanced.

Gold feels like:

- A safety net for long-term holders

- A hedge against economic surprises in 2026

Silver feels like:

- A tactical play for patient investors

- An opportunity, not a guarantee

If you’re buying jewellery, timing matters less than need. If you’re investing, staggered buying still makes the most sense.

Also Read Silver Prices Retreat in 2025 After Brief $80 Rally

What 2025 Is Teaching Us About Precious Metals

This year has reminded investors of one simple truth—gold and silver don’t move just on logic. They move on emotion, fear, and trust.

According to India TV News, people buy gold when they’re unsure about tomorrow. They buy silver when they’re hopeful about growth. That emotional divide is clearly visible in today’s prices.

Final Thoughts: A Calm End to a Noisy Year

As 2025 comes to a close, gold prices today feel like a deep breath after a long year. Not too high, not too weak—just steady. Silver, on the other hand, still has energy, almost impatience.

Personally, I feel gold remains the emotional anchor for Indian households, while silver is slowly finding its place among modern investors. Going into 2026, balance—not panic—will reward those who stay thoughtful.

FAQs About Gold Price Today

1. What is the gold price today in India?

Ans.: Gold price today in India is showing mild fluctuations on MCX, supported by global uncertainty and steady domestic demand.

2. Why is the silver rate more volatile than gold in 2025?

Ans.: Silver prices are influenced by industrial demand, green energy usage, and global commodity movements, making it more volatile than gold.

3. Is 24 carat gold better than 22 carat gold for buyers?

Ans.: 24 carat gold is purer, but 22 carat gold is more durable and preferred for jewellery, especially for daily use.

4. Why do gold prices differ city-wise in India?

Ans.: City-wise gold prices vary due to local taxes, transportation costs, demand levels, and jeweller premiums.

5. Should investors buy gold or silver at the end of 2025?

Ans.: Gold suits long-term safety and wealth preservation, while silver may appeal to investors comfortable with short-term volatility.

Also Read Vedanta Ltd Stock in Focus: 1:5 Split Buzz, Buy or Sell?

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : India TV News & Good Returns - Gold Price Today

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style seamlessly blends market insight with a relatable human voice, making complex data accessible to everyday investors.