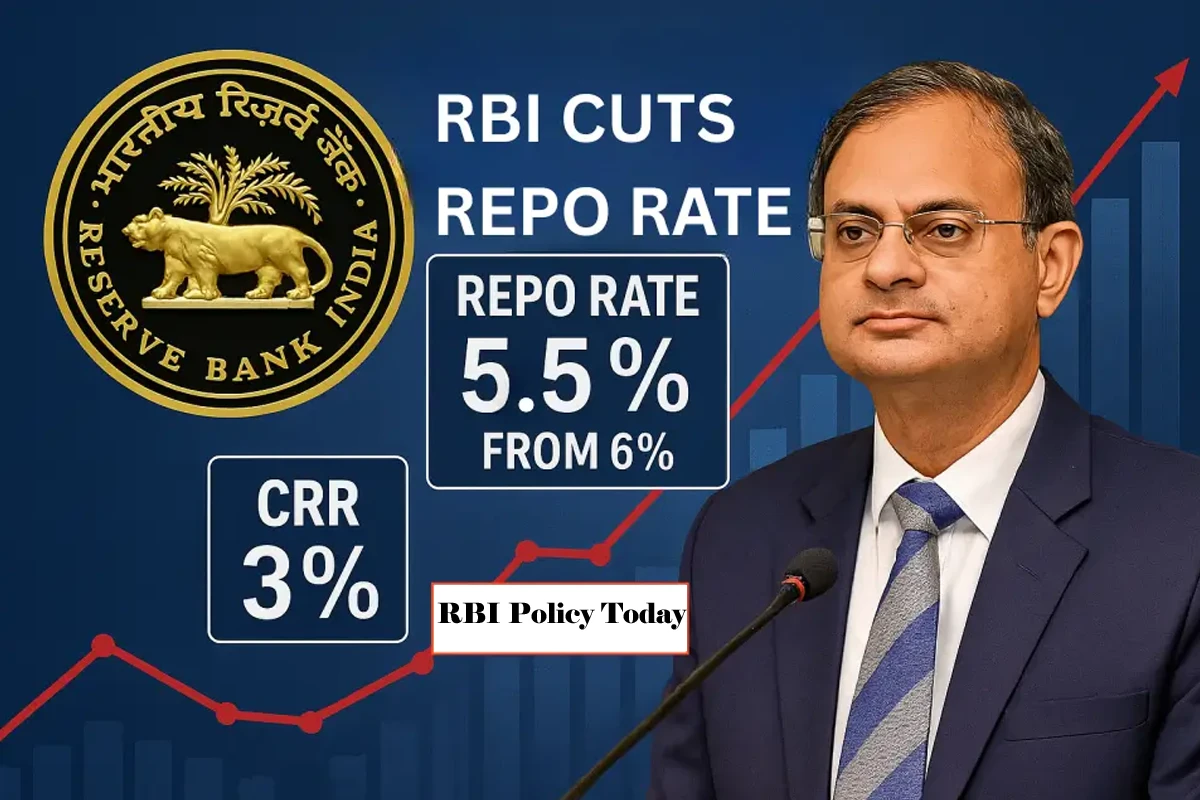

RBI Monetary Policy Update: Repo Rate Stable at 5.5%, Growth Outlook Rises to 6.8%

The most significant news in the economic landscape of India right now is the latest RBI Monetary Policy Update, where the Monetary Policy Committee (MPC) has resolved that the repo rate will stay constant at 5.5%. This decision shows a balance which is important for common people, businesses and investors as inflation now seems to be under control and growth is also getting a new boost. At today’s RBI Monetary Policy Meeting, Governor Sanjay Malhotra also announced that the GDP growth forecast for 2025-26 has been revised to 6.8%, while inflation is projected at just 2.6%.

Repo Rate Stable in RBI Monetary Policy Update

At this RBI MPC meeting, the members of all agreed unanimously to maintain the repo rate at 5.5%. Also, the Standing Deposit Facility (SDF) will be maintained at 5.25%, and the Bank Rate and the Marginal Standing Facility (MSF) will be maintained at 5.75%. This action clearly shows that the RBI is taking a neutral approach right now and is not heading towards any aggressive policy change.

Governor Sanjay Malhotra said in his statement that the inflation outlook has now become quite positive due to falling food prices and rationalization of GST rates While inflation was previously projected at 3.7% in June, it has now fallen to 2.6%, which is a major relief.

Analysis of Inflation Outlook in RBI Policy

The RBI has clarified that headline inflation will remain at a very manageable level for Q4:2025-26 and Q1:2026-27. Core inflation is also expected to remain stable, which is very good news for the average consumer. This means that there will be no additional pressure on the prices of essential commodities in the next few months.

It was also highlighted that the decline in inflation has provided strong support to India’s economy – be it due to a good monsoon, low inflation or GST reforms. However, there is a risk of a slight slowdown in the pace of growth due to global uncertainties and tariffs.

Growth Forecast at RBI Monetary Policy Meeting

One of the biggest highlights of this RBI policy meeting today was the GDP growth forecast. Finally, on growth projections, 2025-26 GDP growth has been revised to 6.8%. In terms of quarters, growth is projected to be 7.0% in Q2, 6.4% in Q3, and 6.2% in Q4. There is a 6.4% growth projection for the first quarter of 2026-27 as well.

This obviously indicates that Indian economy is resilient owing to reforms and domestic demand, but trade-related headwinds and global issues can still be an issue.

RBI Repo Rate and Policy Stance

Today’s RBI monetary policy update has made one thing clear: the repo rate will remain stable for now. The RBI is in a wait-and-watch mode as the full impact of previous policy actions and the government’s fiscal steps has yet to be reflected in the market.

Policy space is also reported to be available by Governor Malhotra, which means that the RBI can initiate action to support growth if circumstances arise. But a cautious stance would be prudent at this time since uncertainties related to trade have not subsided as yet.

Global Economic Impact and RBI MPC Meeting

The Governor also shared his views on the global landscape. On the international front, the Chinese and US economies look robust, but the overall global picture is still not clear. Advanced economies’ inflation continues to be higher than their targets, and that brings in new challenges for those central banks.

Financial markets have also remained volatile. The US dollar has strengthened, treasury yields have risen, and equities are quite buoyant. All these factors indirectly impact India’s economic outlook, so the RBI prefers to remain cautious.

RBI Policy Impact on the Common Man

When we talk about the RBI repo rate remaining stable, it has a direct impact on home loans, EMIs, and small businesses. A decrease in the repo rate would make loans more affordable, but remaining stable means there won’t be any significant relief for now. The biggest relief for the common man is that the fall in inflation has made daily expenses manageable. Its direct benefits are visible on the household budget.

Overall, this RBI Monetary Policy Update has given a clear message that inflation is under control, the outlook for growth is positive, and the RBI, along with its policymakers, is moving forward with prudence and balance.

Disclaimer:

The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Also Read

Netweb Share Price Hits Record High | Stock Surges on AI Orders