“This article expresses my personal analysis based on publicly available financial data and market reports.”

China Factory Activity: Economy Shows Signs of Strain Despite Small Improvement

With the world’s attention focused on China as the world’s biggest manufacturing hub, all eyes were on it lately. But the new data presents a mixed view. Chinese factory activity has improved slightly, but its slump has still extended to six months. This is considered the longest slowdown since 2019. Experts believe that China’s economy is about to face a major challenge, especially after growth reached 5.3% in the first half of the year.

China Factory Activity Data Signals

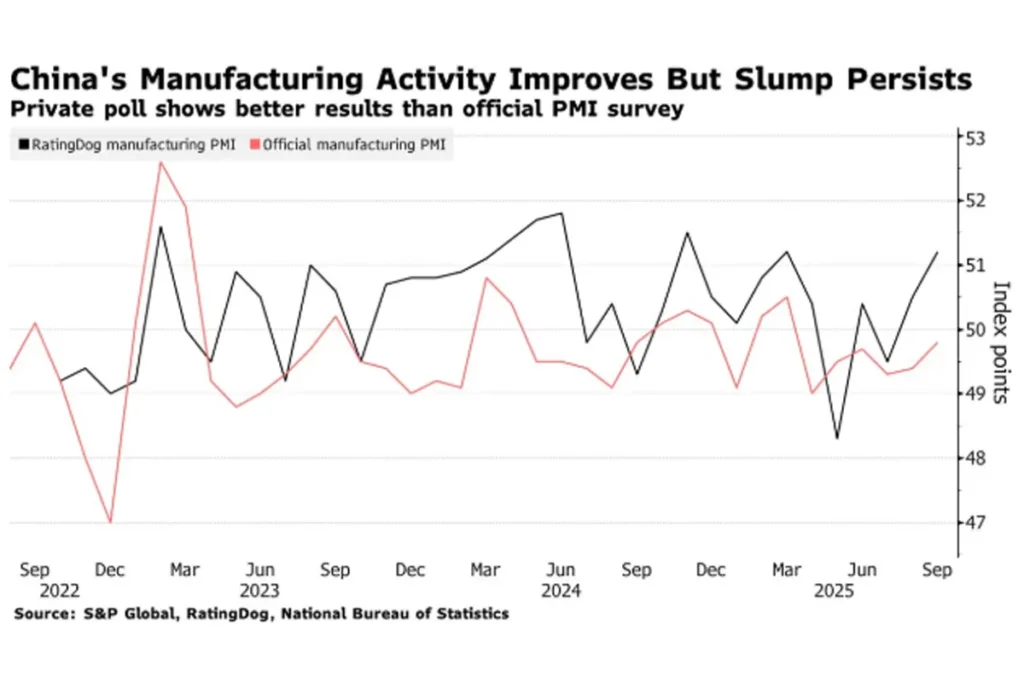

The official manufacturing purchasing managers’ index (PMI) in September was 49.8, little improved from 49.4 in August, reported the National Bureau of Statistics (NBS). Economists had predicted 49.6, so the figure was marginally higher than their expectations. This suggests mild positive signs in Chinese manufacturing activity, but breaking out of the contraction zone remains challenging. A PMI reading below 50 is a clear indicator of contraction.

The non-manufacturing index, measuring the services and construction sectors, also dipped to 50 in September, down from 50.3 in August. This means that the pressure of a slowdown is clearly visible in the services sector and construction as well.

Impact of Weak Demand and Trade Tensions

After weak months in July and August, September data confirmed that weakness within the economy persists. Subdued domestic demand and uncertainty over US tariffs pose a major risk to exporters. Production and new orders indexes improved slightly, but travel-related services—such as catering, sports, and entertainment—contracted in September as the summer holiday season ended.

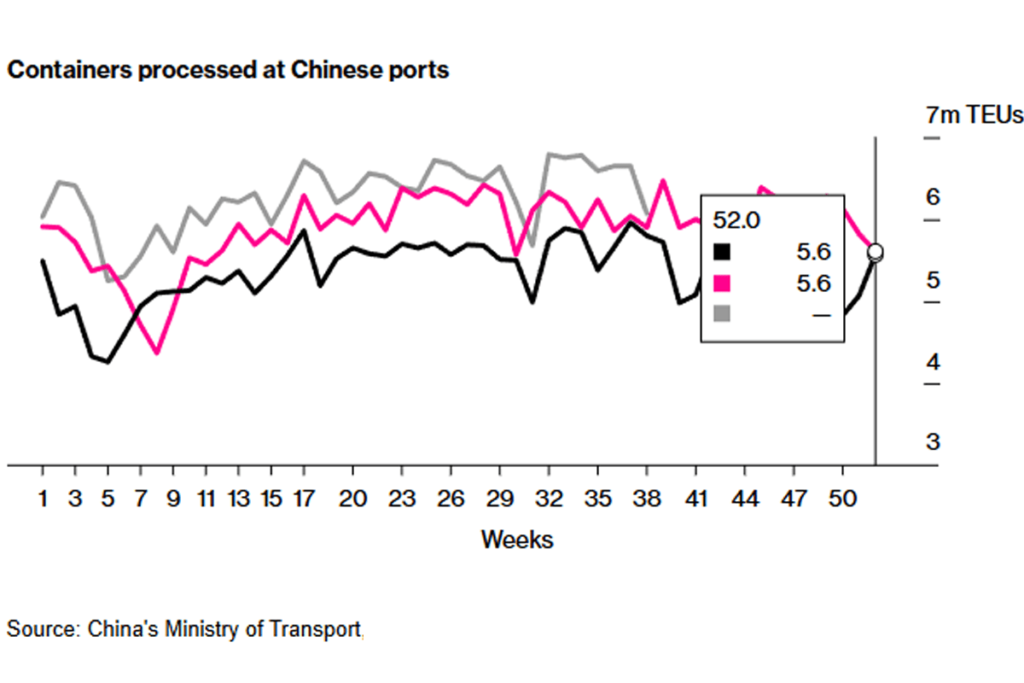

Another problem is that the export boom, which was previously fueled by a shipment rush before US tariffs, is now cooling down. Analysts say the slowdown could become more pronounced in the last quarter of 2025.

Experts’ Analysis

Michelle Lam, Greater China economist at Societe Generale, said that while September data showed marginal improvement, the overall growth outlook remains challenging. Sustaining demand will be difficult due to the tariff impact and the limited effect of government consumption subsidies.

Rating Dog’s private survey results were more optimistic. The Private PMI rose to 51.2 in September, up from 50.5 in August. This is a positive sign as new export orders grew for the first time since March 2025. The Services PMI also came in at 52.9, better than forecast. Private surveys generally focus on small and export-oriented firms, and they tend to be more upbeat than official surveys.

Yao Yu, founder of RatingDog, said, “While new export orders have increased modestly, it is a positive signal that slightly eases market concerns.”

Need for Government Stimulus

The biggest question now is whether the Chinese government will introduce additional stimulus. The Communist Party has scheduled a closed-door meeting in October to discuss development plans for the next five years. Prior to this, China announced a capital release of 500 billion yuan ($70 billion) under a “new financing policy tool” to spur investment.

But an even bigger problem is the real estate sector. China’s property market has yet to recover from the 2021 crisis. Home sales slumped again in August, despite stimulus measures from major cities like Beijing and Shanghai. This sector remains a heavy drag on the economy.

US-China Relations and Global Pressure

There has been some stability in US-China relations, especially after the recent phone call between the leaders. Next up is another challenge as the 90-day tariff truce ends in early November. At that time, US President Donald Trump and Chinese President Xi Jinping will meet at the Asia-Pacific Economic Cooperation summit in South Korea, where more clarity is anticipated.

Alongside, the government’s drive to eliminate overcapacity and competition that is cuttingthroat is also putting pressure on the economy. Output of products like steel has fallen, and intense competition has forced manufacturers to cut their selling prices.

China Manufacturing Activity Outlook

ING Bank economist Lynn Song says that China’s growth is currently being supported by strong external demand. However, recent PMI and inflation data suggest that further policy support will be needed. It is clear that both Chinese manufacturing activity and Chinese factory activity are at a turning point. According to experts, if domestic demand does not revive and tariff pressures mount, the slowdown may deepen.

However, a few analysts opine that if the government comes up with timely fiscal and monetary assistance, a small recovery may be on the cards in the fourth quarter of 2025. Till then, however much optimism private surveys indicate, official statistics point to the same danger.

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : Bloomberg - Chinese Factory Activity

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview and financial trends since 2019. His writing style blends market insight with a relatable human voice — making complex data simple for everyday investors.