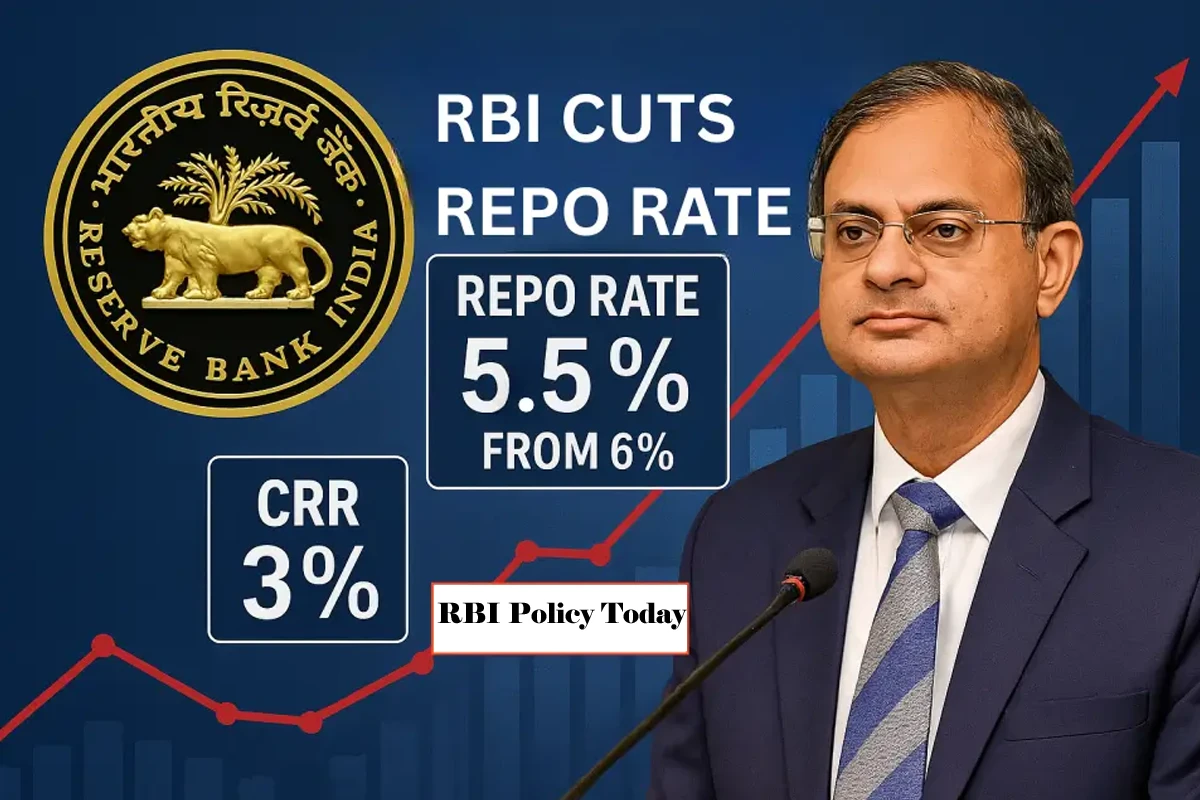

RBI Repo Rate News: Remains Steady at 5.5%, RBI MPC Meeting Highlights Global Worries

In today’s time, economic news has a direct effect on the life choices of every individual. We are talking about RBI repo rate news here, which affects not just big enterprises but also middle-class households, students, and small-scale enterprises. Post RBI Monetary Policy Meeting in October, Governor Sanjay Malhotra came out with the announcement that the repo rate will continue to be steady at 5.5% for the moment. This decision provides stability to the public, along with drawing attention to global market issues—like US tariffs and risks of trade. Further, the GDP growth forecast has been recalculated to 6.8%, which is a welcome change.

RBI Policy Today: Repo Rate Unchanged, Stance Neutral

The biggest takeaway from today’s RBI policy was that there was no change in the repo rate. Governor Malhotra stated that inflation is now at manageable levels, and the repo rate will remain at 5.5% for the time being. The Standing Deposit Facility (SDF) was also maintained at 5.25%, while the Marginal Standing Facility (MSF) and Bank Rate were maintained at 5.75%.

The Monetary Policy Committee (MPC) took a unanimous decision to remain neutral. The decision gives assurance to the masses, as it is directly connected to their home loan EMIs and investment strategy. The festive season has started, and a stable repo rate provides people with a comfort zone during this season – whether to purchase a home or create new investments.

RBI Policy News: Low Inflation, High Growth Predicted

One of the key highlights of the RBI policy news today was declining inflation. The RBI Governor revealed that CPI inflation should be at 2.6% this year, compared to the June estimate of 3.7% and the August estimate of 3.1%. This reduction was largely contributed by the regulation of food prices as well as the stimulating effect of GST reforms.

As far as growth is concerned, the RBI adjusted the GDP forecast to 6.8%. Estimates of growth are 7% in Q2, 6.4% in Q3, and 6.2% in Q4. This clearly indicates that India’s economy will continue to remain on the move because of favorable monsoons and robust domestic demand.

RBI Monetary Policy: Focus on Developed India

Governor Malhotra also shared a vision in his remarks. He stated that India must achieve its dream of a developed India by 2047, and that a synergy of fiscal, monetary, and regulatory policies is essential.

This time, the RBI monetary policy also announced important steps for exporters. The repatriation period for exporters’ foreign currency accounts has been extended from one month to three months. Furthermore, the time for merchant trade transactions for forex outlets has been extended from four months to six months. These steps directly support ease of doing business.

RBI Meeting Today: Hope for the Real Estate Sector

The festive season is always a golden period for real estate. Ramani Sastri, CMD of Sterling Developers, said that with the repo rate unchanged, loan terms for homebuyers will remain predictable and housing demand will remain stable. A rate cut would further improve affordability, but current stability is also positive.

Manju Yagnik, Senior VP of NAREDCO Maharashtra, said that RBI’s consistency is an enabler. The combination of festive demand, GST relief, and stable EMIs will make the housing sector stronger in 2026. Clearly, today’s RBI news has provided clarity to both homebuyers and developers.

Trade Uncertainties and Global Risks

The MPC acknowledged that global uncertainties such as US tariffs, rupee depreciation, and weak export demand remain a challenge. But he also stated that India’s domestic demand, good harvest, and government spending will cushion the economy.

Policymakers stated that the prudent step for now is to keep the repo rate stable and see how the full impact of previous policy actions unfolds. Therefore, a cautious optimism was displayed at the October RBI MPC meeting.

RBI Repo Rate: Stability Builds Confidence

When people pay EMIs or plan to buy a new home, a predictable repo rate environment is crucial. This time, the RBI repo rate news has provided that confidence. Inflation is down, the growth outlook is better, and the RBI has also shown that it is alert to global uncertainties.

The RBI’s balanced approach provides investors with confidence and reassurance to middle-class families. Buying a home, taking out a loan for education, or managing a major expense through EMIs—all of these are directly linked to the repo rate. Keeping the repo rate unchanged means people will be able to manage their future plans with predictability.

Reminding us that monetary policy is not about manipulating only interest rates and inflation, being neutral is. Its actual aim is to find a proper balance between growth and stability, so the economy can develop at a sustainable and stable rate.

Disclaimer:

The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Also Read

Seshaasai Technologies Share Price: IPO Listing Gains, GMP Buzz & Future Outlook