Bajaj Housing Finance Share: What is the reason for the stock going down?

Bajaj Housing Finance Share has now become a cause of concern for many investors. In the last 11 months, Bajaj Housing Finance Stock has fallen 32% below its listing price. For those who were expecting a quick rebound from this stock, this is a time of some patience, as there is still a lot of uncertainty in the market. According to the latest report of Motilal Oswal, the near-term recovery of the stock seems to be quite limited, and this is the reason why investors should remain cautious.

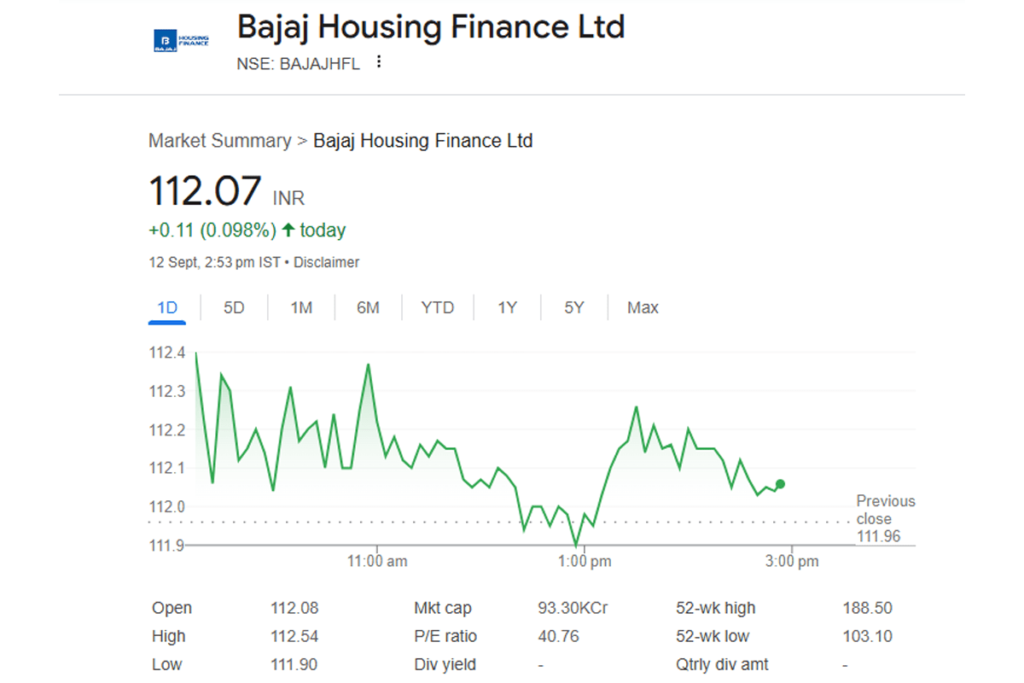

Bajaj Housing Finance Stock has been struggling since its blockbuster debut in September 2024. Compared to the listing price of ₹165, the stock has fallen to almost ₹112, and in the last 11 months, the stock closed in the negative zone for 9 months. The major reason behind this is rising competition from banks and other HFCs, which is putting pressure on the company’s yields and overall performance.

Motilal Oswal Analysis: Bajaj Housing Finance Share

Motilal Oswal has given Bajaj Housing Finance Share a ‘Neutral’ rating and has set a target price of ₹120. Meaning, if the stock reaches this target, investors can get an upside of only 7%. The brokerage firm has highlighted the company’s strong asset quality, robust credit profile, leading HFC franchise, and diversified AUM mix. But he also pointed out that rising competition from banks can have an impact on growth and ROE.

The main factor behind Bajaj Housing Finance Stock Down is high competition in the market. BHFL is facing very tough competition from banks and large HFCs. Due to this, the company is facing challenges in maintaining loan growth, and there may be short-term pressure on net interest income (NII).

Bajaj Housing Finance Stock Down: What are the Challenges

The share of non-housing loans has increased from 38% to 44% from FY22 to FY25, but the company’s spreads have fallen by 90 basis points in the last 3 years. Due to rising borrowing costs and competitive pressure, BHFL is not able to pass on this additional cost to customers. As per Motilal Oswal‘s projection, NIMs and spreads are expected to remain broadly stable in FY26. The impact of lower yields due to the cut in lending rates will be offset by the reduction in borrowing costs, and NIM is estimated to remain roughly 3.3% for FY26-27.

Apart from this, brokerage expects that non-interest income may soften a bit this year. Meaning, some more headwinds can be seen on the performance of the stock in the short-term.

Valuation Premium and Stock Returns

Bajaj Housing Finance Share valuation is still high. According to brokerage analysis, RoE is expected to remain moderate (12-14%), due to intense competition and low prime home loan yields. Bajaj Group’s strong execution capabilities provide credibility, but the combination of premium valuations and modest RoE profile could result in subpar stock returns in future.

BHFL is currently trading at 3.6x P/BV and 29x FY27E P/E, which is 60% premium to the IPO price. Motilal Oswal has modelled AUM and PAT CAGR expected to remain at 22% for FY25-28E and has estimated RoA and RoE to remain at 2.3% and 14% in FY28E.

Should Investors Be Careful?

Despite the fall in Bajaj Housing Finance Stock, there are no signs of short-term recovery in the market yet. But for long-term investors, the company’s strong fundamentals and diversified portfolio stand as a positive and reassuring factor. But, keeping in mind the combination of rising competition, moderate RoE, and premium valuation, caution is a must.

Bajaj Housing Finance Share is a stock that can provide potential growth for long-term investors, but volatility is quite high in the short-term. Hence, it is important to do proper research and take advice of a certified financial advisor before taking financial decisions.

Disclaimer:

The information given in this article is based on stock exchange data and official company announcements. Stock market and Bajaj Housing Finance Stock investments always come with risk. Before taking any financial decision, definitely take the advice of your financial advisor or a certified expert.

Also Read

Mcap of Top Companies 2025: Bajaj Finance & Reliance Lead Market Gains