Best Stock to Buy: Apple vs. Amazon – Which Stock Would Be Best for You?

The most common question in today’s financial markets is which is the best stock to buy? Investors are always looking for options that can provide them with good long-term returns. And when it comes to two major tech giants – Apple and Amazon – the comparison becomes even more interesting. Both companies are among the most valuable enterprises in the world, and both have generated excellent returns for their investors over the past decade. But if you had to choose only one stock right now, which would be the right one? Let’s take a closer look in this article.

Best Stock to Buy: Apple’s Brand Power and Profits

Apple is now not only a technology company, but has risen to the status of quality and reliability symbol. The whole world thinks about Apple devices as an ordinary product, but a symbol of high-end lifestyle. The power of this brand gives it strong pricing and consistent profits for its products. Products like iPhone, MacBook, iPad and Apple Watch together create an ecosystem in which once a user enters, it becomes very tough for them to shift to any other brand.

This ecosystem is Apple’s biggest weapon. Once a consumer enters the Apple world, it naturally extends to iCloud, Apple Music, and wearables. This cycle provides the company with recurring revenue and stable profits.

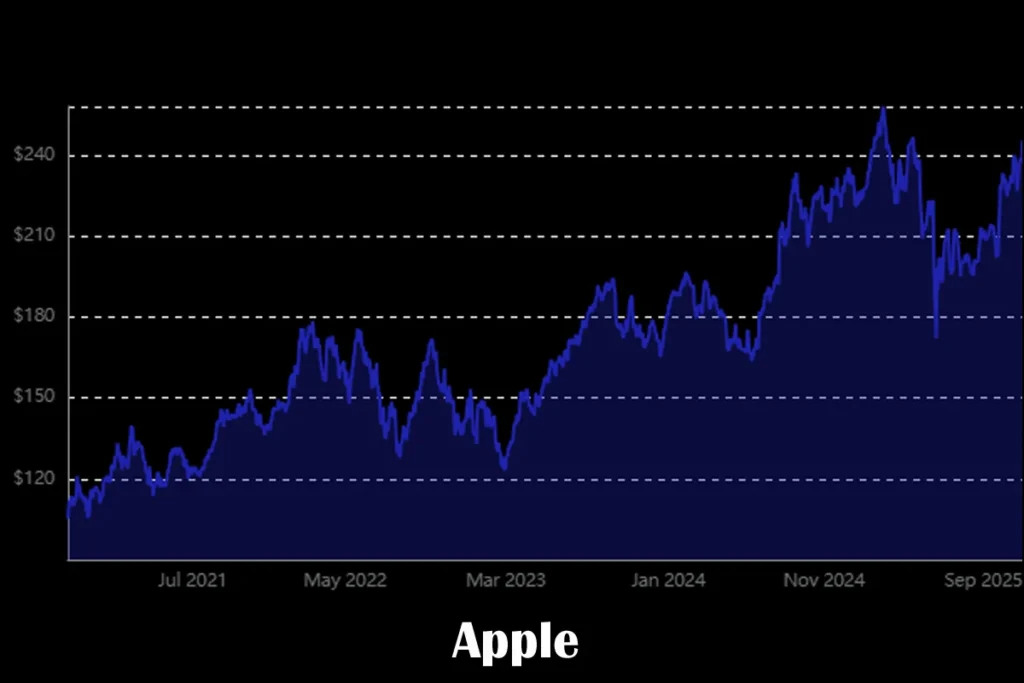

Seeing the numbers, Apple’s financial health is equally impressive. In Q3 2025 alone, the company earned $23.4 billion in net income. Its average profit margin over the past 10 years has been 23%, a benchmark for any technology company. Additionally, the company conducts regular stock buybacks for shareholders—$21 billion worth of shares were bought back in the last quarter alone. All of this makes Apple a safe and secure investment option.

Best Stock to Buy: Growth Story of Amazon and AWS

Like Apple, Amazon is a strong business, but its growth story is slightly different. Amazon operates in multiple industries—e-commerce, digital advertising, cloud computing (AWS), streaming, and now even the healthcare and grocery sectors. This diversification is its strength.

The most promising segment for Amazon is Amazon Web Services (AWS). Cloud computing is a fast-growing market that will witness even higher demand in the future, particularly with the addition of AI. AWS currently accounts for over half of Amazon’s total operating revenue. This means that as AI and cloud demand increases in the future, Amazon’s growth could accelerate.

Digital advertising is also becoming a goldmine for Amazon. In Q2 alone, it generated $15.7 billion in ad revenue, a 22% growth. This is a high-margin company that increases the profitability of the firm. CEO Andy Jassy has made tremendous strides in improving the profitability of the firm by emphasizing operational efficiency. Amazon Q2 net income has increased 250% over the last 5 years.

Apple vs. Amazon: Best Stock to Buy Now

The question now is, which of the two is the best stock to buy right now? Apple is undoubtedly a safe and stable option, with its brand loyalty and premium pricing power providing long-term stability. But if you’re a little risk-averse and want high growth, Amazon may be a better bet.

Amazon’s valuation is also reasonable – its forward P/E ratio is 30.1, which looks attractive considering its growth potential. Both its AWS and digital advertising segments could make Amazon a multi-industry leader in the future.

Apple’s growth is at a slightly mature stage, meaning its future returns may moderate. However, Amazon currently has multiple markets open, making it a more rewarding option over the next five years.

Risks and Considerations Before Choosing the Best Stock to Buy

Investments aren’t always solely driven by profit and expansion; knowing the risks involved is just as crucial. Apple’s largest concerns are regulatory rules and supply chain management, which become even more problematic in times of global trade tensions.

For Amazon, overly stringent regulations, saturation of the e-commerce markets, and excessive dependence on AWS may be a problem. If cloud use tapers off, it can hit Amazon’s overall profits straight away.

So, when making a choice about which is the optimal stock to invest in, it’s important to know your investment goals and risk tolerance.

Conclusion: Best Stock to Buy – Apple or Amazon?

If you’re looking for a stock with steady and predictable growth, with relatively low volatility, Apple could be a strong pick. However, if you’re looking to invest in a stock with a little more risk and a faster growth potential, Amazon could be considered the best stock to buy right now.

Both companies are trillion-dollar valuation giants, and investing in both could create a smart diversification strategy. However, if you have to choose only one option, Amazon’s future growth potential currently appears more promising than Apple’s.

Disclaimer:

The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Also Read

Snap Stock Soars After Snap OS 2.0 & New Spectacles Launch – Is It Still Undervalued?