“This article expresses my personal analysis based on publicly available financial data and market reports.”

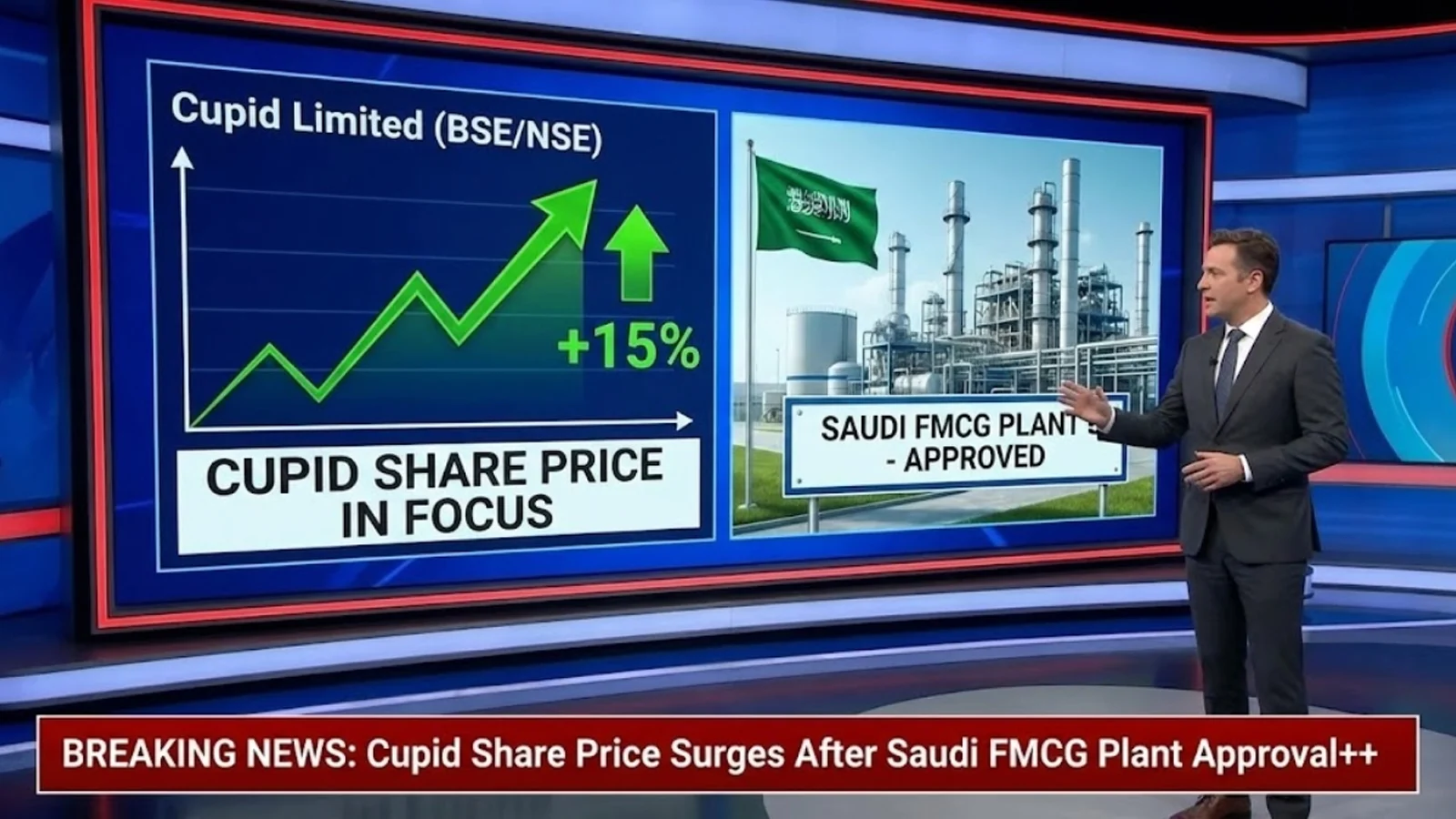

Cupid Shares Hit All-Time High in 2025: What’s Fueling This Stunning Rally?

The Indian stock market has seen many surprise performers in 2025, but very few stories are as eye-catching as Cupid shares. Once considered a quiet, under-the-radar stock, Cupid Ltd has turned into a market sensation.

In 2025 alone, Cupid’s stock has surged over 550%, hitting fresh all-time highs and leaving both retail and seasoned investors stunned. So what exactly is driving this rally—and is it still worth tracking?

Let’s break it down in simple, human terms.

Why Cupid Share Price Is Making Headlines in 2025

The Cupid share price rally didn’t happen overnight. It’s the result of multiple strong triggers coming together at the right time.

Investors are rewarding the company for consistent performance, clear growth visibility, and improved financial strength. In a market where trust matters, Cupid has quietly built credibility quarter after quarter.

This is why the stock has become a frequent topic on platforms like MSN, Mint, and market trackers.

Also Read Gold Price Today, Silver Rate on MCX | India Dec 30, 2025

Strong Financial Performance Sparks Investor Confidence

One of the biggest reasons behind Cupid’s rise is its improving financials.

The company has reported:

- Better revenue visibility

- Stable profit margins

- Improved operational efficiency

In 2025, investors are not chasing hype alone. They want numbers that speak, and Cupid’s balance sheet is doing exactly that.

When earnings consistency meets low debt pressure, the market usually reacts fast—and that’s exactly what happened here.

Government Orders and Export Growth Add Momentum

Cupid operates in the medical and healthcare segment, which has remained a priority sector in India.

The company benefits from:

- Government-backed health initiatives

- Strong demand for contraceptive and medical products

- Rising export orders from international markets

In 2025, global healthcare supply chains will be restructured, and Indian manufacturers will gain more space. Cupid is clearly riding this wave.

This export visibility gives investors long-term comfort, not just short-term excitement.

Small-Cap Stock, Big Market Trust

Cupid’s rally also reflects a broader trend in 2025—renewed interest in quality small- and mid-cap stocks.

With large-cap stocks offering limited upside, investors are actively hunting for:

- Niche businesses

- Clean management track records

- Scalable growth models

Cupid fits perfectly into this checklist.

According to MNS, its shares are actively traded on NSE and BSE, with volumes rising steadily—another sign of growing institutional and retail participation.

Technical Charts Signal Strong Momentum

From a technical perspective, Cupid shares are showing:

- Higher highs and higher lows

- Strong breakout above previous resistance levels

- Sustained buying interest on dips

In simple words, the trend is clearly bullish.

Momentum traders love such setups, and long-term investors see this as confirmation of underlying business strength.

Is the Cupid Share Price Overheated?

This is the most common question investors are asking right now.

A 550% rally does raise eyebrows, no doubt. Short-term corrections are always possible after such sharp moves. But that doesn’t automatically mean the story is over.

In 2025, markets are rewarding earnings-backed growth, not random speculation. As long as Cupid continues to deliver on fundamentals, investor interest is unlikely to fade overnight.

Still, fresh investors should stay cautious and avoid chasing prices blindly.

What Makes Cupid Different From Other Rally Stocks?

Many stocks rise fast—and fall even faster. Cupid stands out because:

- The rally is supported by business growth

- Demand comes from both domestic and export markets

- The company operates in a defensible healthcare niche

This combination is rare, especially in the small-cap space.

That’s why analysts and market watchers are calling Cupid’s rise a “quality-driven rally”, not a speculative spike.

Also Read Hindustan Copper Shares Surge 50% in 7 Days: Why in 2025

What Should Investors Watch Going Forward?

If you’re tracking Cupid shares in 2025, keep an eye on:

- Quarterly earnings consistency

- New government or export contracts

- Raw material cost trends

- Management commentary on future growth

These factors will decide whether Cupid’s rally turns into a long-term success story.

Final Thoughts

Honestly, stories like Cupid remind me why Indian markets are so exciting. A small company, strong execution, and patient investors—this is how real wealth gets created.

That said, every sharp rally deserves respect, not blind excitement. Cupid has earned its spotlight in 2025, but smart investing still means discipline.

If the company continues doing the basics right, this might not be the end of the journey—just a powerful chapter.

FAQs About Cupid Share Price

1. Why are Cupid shares rising so sharply?

Ans.: Cupid shares are gaining momentum due to improving financial performance, steady demand in the healthcare segment, and rising investor confidence. The rally is backed by fundamentals, not speculation.

2. Is Cupid a multibagger stock?

Ans.: Yes, based on its 2025 performance, Cupid has delivered multibagger returns. However, future returns will depend on earnings consistency and overall market conditions.

3. What is driving investor interest in Cupid stock?

Ans.: Investors are attracted by Cupid’s niche healthcare business, export potential, and clean balance sheet. In 2025, such quality small-cap stories are getting premium valuations.

4. Can Cupid stock continue its rally in 2026?

Ans.: The outlook remains positive if the company maintains earnings growth and demand momentum. Short-term corrections are possible, but long-term direction depends on execution.

5. Is Cupid stock risky for new investors?

Ans.: Like all small-cap stocks, Cupid carries volatility risk. New investors should avoid chasing prices and consider gradual entry with a long-term view.

Also Read Vedanta Ltd Stock in Focus: 1:5 Split Buzz, Buy or Sell?

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : MSN & Upstox - Cupid Share Price

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style seamlessly blends market insight with a relatable human voice, making complex data accessible to everyday investors.