“This article expresses my personal analysis based on publicly available financial data and market reports.”

Excelsoft Technologies IPO Lists at 12.5% Premium on NSE — How Much Investors Made Per Lot

The market opened today with a spark of excitement as Excelsoft Technologies made its SME debut on NSE. The stock listed at a 12.5% premium, surprising many investors who were expecting a mild listing due to recent volatility.

Moments like this remind us why IPOs still attract young and seasoned investors. A well-performing debut brings a mix of relief, excitement, and confidence that the market mood is improving again.

Excelsoft Technologies IPO Listing — Focus Keyword Inside

Excelsoft Technologies is listed at ₹140 per share, against the issue price of ₹124.

For investors who grabbed one retail lot of 1,000 shares, the listing gain came to nearly ₹16,000.

That’s a solid start for a company operating in the fast-growing edtech and digital learning solutions space.

What made this debut even sweeter was the strong subscription numbers during the IPO window. Retail investors, HNIs, and even small institutions showed interest, signalling confidence in the company’s long-term potential.

Also Read ITR Refund Delay Explained: CBDT Chief Reveals 2025 Update

Why Excelsoft’s Debut Matters in 2025 — IPO Market Trends

If you look at 2025’s SME IPO trend, a few patterns stand out.

Many SME companies are witnessing strong subscriptions, but not all are seeing double-digit listing pops. This is because investors are more selective now, focusing on real revenue growth and profitability rather than hype.

Excelsoft’s steady financial performance and long track record in digital learning made it different. Educational technology continues to grow, especially as schools, companies, and institutions adapt to hybrid learning models.

The listing premium shows that the market rewarded fundamentals over buzz — something we rarely saw during the 2021–22 IPO boom.

How Much Investors Earned Per Lot — Real Example

Let’s break it down with a simple real-world calculation:

- Issue Price: ₹124

- Listing Price: ₹140

- Gain Per Share: ₹16

- Retail Lot Size: 1,000 shares

- Total Profit on Listing: ₹16,000

For many retail investors, earning ₹16k in a single day feels like a small victory, especially in a year where the market has been unpredictable.

Some investors shared online that they were relieved after taking the risk because SME listings can swing wildly on Day 1. This emotional win matters just as much as the financial one.

Excelsoft Technologies Share Price — What Analysts Expect Next

Analysts tracking SME IPOs say the strong debut doesn’t guarantee a smooth journey ahead. The coming weeks will depend on:

- Buying interest in the broader market

- Company announcements

- Quarterly performance

- Investor sentiment in the edtech and IT services sector

But the debut shows strong confidence.

If the stock sustains above the listing price and builds volume, it may attract short-term traders as well. A few experts even feel the company, with its digital learning solutions, sits in a future-ready industry.

Excelsoft IPO: What Worked for the Company

A few factors clearly boosted its listing:

1. Strong business model

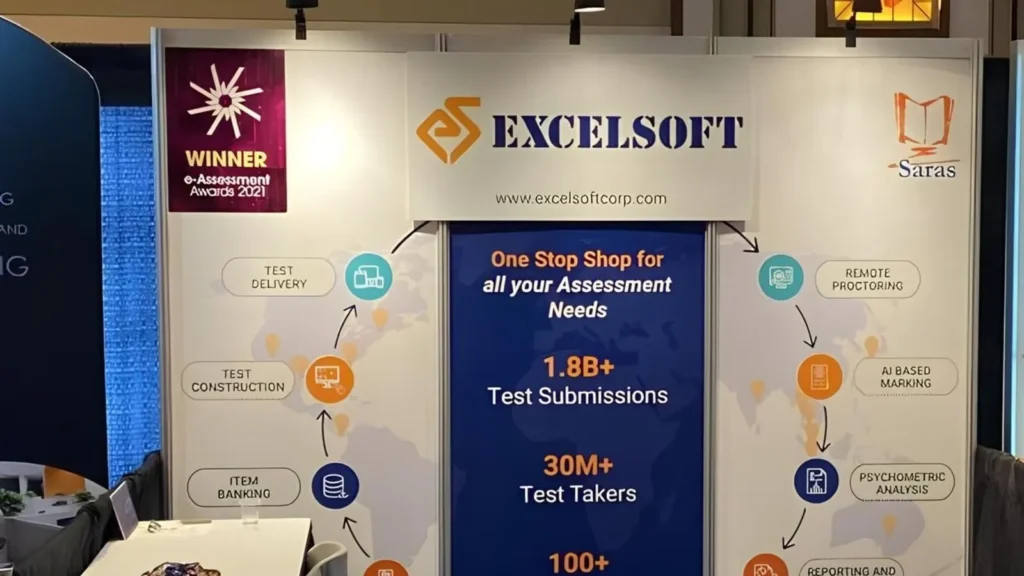

Excelsoft provides digital learning, assessment, and test-prep software to institutions. As the world moves toward remote training, this market continues to grow.

2. Clean financials

Investors prefer companies with a stable revenue pattern, especially in SME listings.

3. Wider edtech demand in 2025

Schools, employers, and training platforms want smarter, AI-based learning tools. Excelsoft fits right into this trend.

4. Reasonable IPO pricing

The valuation wasn’t stretched. This helped build trust among retail buyers.

Investor Sentiment

Many retail investors I spoke to online say they’re tired of overhyped IPOs and prefer steady, reliable businesses. Excelsoft seemed like a “safe bet” because of its mature model and long presence in the edtech ecosystem.

One investor shared that he applied mainly because his daughter uses digital learning tools every day. “If learning is going digital, companies like these will grow automatically,” he wrote.

This is the kind of real-world connection that drives modern investing.

Also Read Groww Q2 Profit Rise: What It Means for India’s Wealth Market

Will Excelsoft Technologies Sustain This Premium?

This is the big question.

The listing gain is impressive, but now the company needs to:

- Deliver consistent growth

- Improve margins

- Add new institutional clients

- Strengthen global presence

If it does this, the stock could remain stable or even move upward.

But if market sentiment turns weak, SME stocks usually react sharply.

Conclusion

Excelsoft’s listing felt refreshing. In a year when investors are being extra cautious, a clean and confident debut restores trust in the SME segment.

The 12.5% premium isn’t just a number — it reflects the market’s belief that real business value still wins. As someone who follows IPOs closely, this listing made me optimistic about upcoming offerings in 2025.

If Excelsoft delivers consistent results, this stock could become a stable performer in the SME space.

FAQs About Excelsoft Technologies IPO

1. What was the listing price of Excelsoft Technologies IPO?

Ans.: Excelsoft Technologies made its NSE SME debut at around ₹140 per share, which was a solid 12.5% premium over its issue price of ₹124.

2. How much profit did investors make from the Excelsoft Technologies IPO?

Ans.: Retail investors who got one lot of 1,000 shares earned close to ₹16,000 on listing day as the stock gained ₹16 per share over the issue price.

3. What is driving interest in Excelsoft Technologies?

Ans.: Excelsoft Technologies operates in the digital learning and edtech space, a sector that continues to grow in 2025 as schools and companies adopt hybrid training models.

4. Is Excelsoft Technologies GMP today strong?

Ans.: Excelsoft GMP today showed steady premium signals before the listing, reflecting healthy investor interest and confidence in the company’s business model.

5. Can Excelsoft Technologies sustain its listing premium?

Ans.: Sustaining the premium depends on the company’s upcoming financial performance, market sentiment, and how quickly it expands its digital learning solutions business. If it delivers consistently, the stock could remain stable or even climb further.

Also Read Capillary Technologies IPO Lists at ₹571.90 — Soft Start for SaaS Firm

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : Upstox & Mint - Excelsoft Technologies IPO

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style seamlessly blends market insight with a relatable human voice, making complex data accessible to everyday investors.