“This article expresses my personal analysis based on publicly available financial data and market reports.”

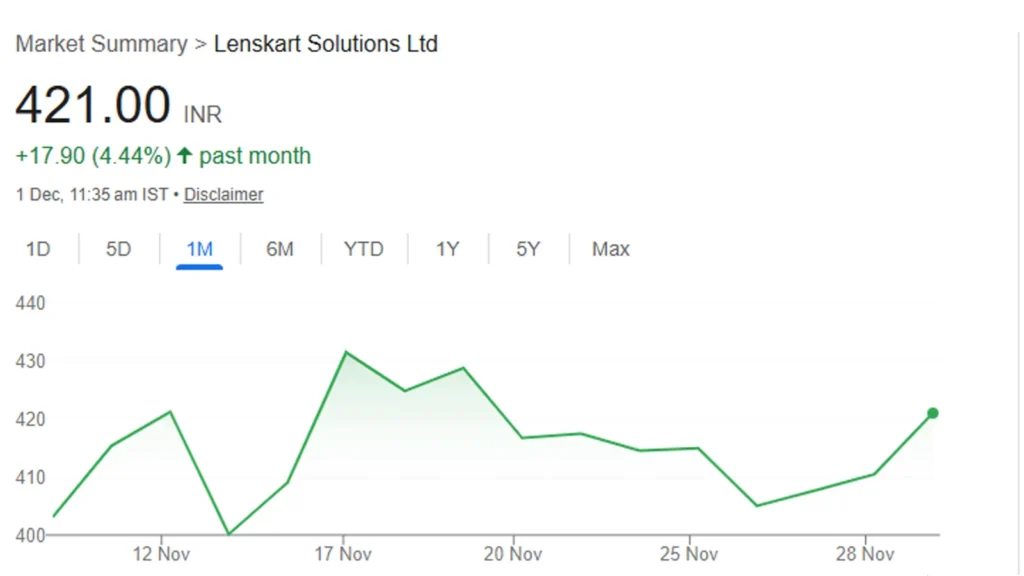

Lenskart Share Price Surges Over 5% As Q2 FY26 Results Impress Investors

The stock market loves a good comeback story. And that’s exactly what played out today with Lenskart’s share price jumping more than 5%. For a company fresh after its IPO, this is an important moment — one that signals growing confidence among retail and institutional investors.

This surge came right after the company announced its first quarterly results post listing, and the numbers clearly struck the right emotional chord in the market.

Strong Q2 FY26 Results Fuel Fresh Optimism

The latest earnings report shows the eyewear giant is not slowing down. Robust revenue growth, better margins, and a stronger omnichannel presence helped boost the Lenskart share price in early trade.

According to the report, Lenskart recorded positive traction across both online and offline stores. Investors were keenly watching this because many companies struggle after listing. But Lenskart seems to be moving confidently, and the market rewarded that trust.

One trader described the day as “a breath of fresh air in a volatile market.” This emotional sentiment was widely visible across social platforms too, where retail investors shared screenshots celebrating the morning rally.

Also Read Aequs IPO 2025: GMP, Price, Lot Size, Review & Full Details

Why Lenskart Share Price Is Rising: Key Drivers Explained

Short answer? The company’s business model is working.

Lenskart has built a strong identity in India’s growing eyewear market. It has invested in quality manufacturing, rapid delivery, and affordable pricing — something Indian consumers strongly connect with.

Here are the biggest factors pushing the Lenskart share upward:

- Revenue growth beating expectations

The company’s topline showed healthy expansion in Q2 FY26, reflecting strong demand. - Offline stores generating high footfall

The brand’s presence in malls and high-street areas continues to grow. - Smart supply chain improvements

Faster deliveries and better cost control helped improve margins. - Post-IPO confidence

This is Lenskart’s first earnings result after going public, and beating expectations immediately boosts investor sentiment.

These interconnected wins painted a picture of stability at a time when many newly listed startups face pressure.

Real-World Example: How Consumers Are Driving Growth

Walk into any metro mall, and it’s hard to miss the crowd at a Lenskart store. People checking frames, waiting for eye tests, and discussing lens options — it’s become a mini ritual for many young urban shoppers.

A friend of mine visited a Lenskart store in Delhi last week and said, “I walked in just to browse, but ended up buying a pair because the staff made it so quick. I didn’t even feel like I was shopping — it felt like a service.”

That’s the real secret behind the rising Lenskart share price — the company has built trust on the ground.

What Q2 FY26 Results Indicate for Future Share Price Growth

The company’s numbers aren’t just strong on paper. They reveal a strategic shift that aligns well with 2025–2026 retail trends:

- Consumers prefer hybrid shopping (online + offline)

- Affordable premium products are growing as a category

- Tech-enabled retail is outperforming traditional players

Lenskart’s integration of mobile app ordering, AI-based recommendations, and express delivery positions it perfectly for this trend cycle.

If the company maintains this momentum, analysts believe the Lenskart share price could see periodic surges, especially during peak retail quarters.

Investor Sentiment: What the Market Is Saying Today

Market experts reacted positively to the Q2 FY26 numbers, calling the stock “one of the more stable consumer-tech plays” among recent IPOs.

On social media, retail investors used words like “finally,” “solid,” “trustworthy,” showing that the company has managed to strike an emotional connection. Many were also comparing Lenskart to Titan’s early growth phase — a big compliment for any consumer-facing brand.

At the same time, some analysts remain cautious, reminding investors that valuations are still high. They advise tracking operational costs and cash flows closely in the upcoming quarters.

Still, the tone today was overwhelmingly upbeat, contributing to the surge in the Lenskart share price.

Also Read Meesho IPO on Dec 3: Key Details Investors Must Know

What This Means for New Investors in 2025

If you’re following consumer-tech stocks, Lenskart is now a key name to watch in 2025. The company is expanding aggressively, investing in technology, and strengthening its manufacturing ecosystem in India.

The eyewear market is still largely underpenetrated, giving Lenskart huge room to grow.

Investors looking for growth-oriented retail plays often chase companies with strong branding and loyal consumer bases — Lenskart checks both boxes.

Conclusion: A Confident Start After IPO

Today’s jump in Lenskart share price isn’t just about numbers. It’s about trust.

It’s refreshing to see a newly listed company deliver strong results right out of the gate. As someone who follows consumer-tech stocks closely, I genuinely feel Lenskart is entering a promising phase. The company still has challenges ahead, but today’s performance shows it has the discipline and direction to move forward with confidence.

For now, investors are clearly cheering — and they have good reason to.

FAQs About Lenskart Share Price

1. Why did Lenskart share price rise today?

Ans.: Lenskart share price rose over 5% after the company announced strong Q2 FY26 results, showing healthy revenue growth, expanding offline stores, and higher investor confidence post IPO.

2. Is Lenskart a good stock to buy in 2025?

Ans.: Analysts believe Lenskart has long-term growth potential due to its strong brand presence, tech-driven retail model, and rapid offline expansion. However, investors should consider valuations and risk appetite before investing.

3. What are the key drivers for Lenskart share price?

Ans.: Key drivers include strong quarterly earnings, increased customer footfall, efficient supply chain improvements, and a rising demand in India’s eyewear market.

4. How did Lenskart perform in Q2 FY26?

Ans.: Lenskart reported impressive Q2 FY26 results with strong revenue growth, improved margins, and consistent performance across both online and offline channels.

5. What is the outlook for Lenskart stock in 2025?

Ans.: The outlook for Lenskart stock in 2025 appears positive due to expanding retail footprint, improving financials, and rising consumer demand. Still, market conditions and competition should be monitored closely.

Also Read GAIL Share Price Falls 6.5% Despite Tariff Hike — Here’s Why

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : Times of India & Moneycontrol - Lenskart Q2 Profit

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style seamlessly blends market insight with a relatable human voice, making complex data accessible to everyday investors.