“This article expresses my personal analysis based on publicly available financial data and market reports.”

What’s Going On with Bajaj Finserv Today

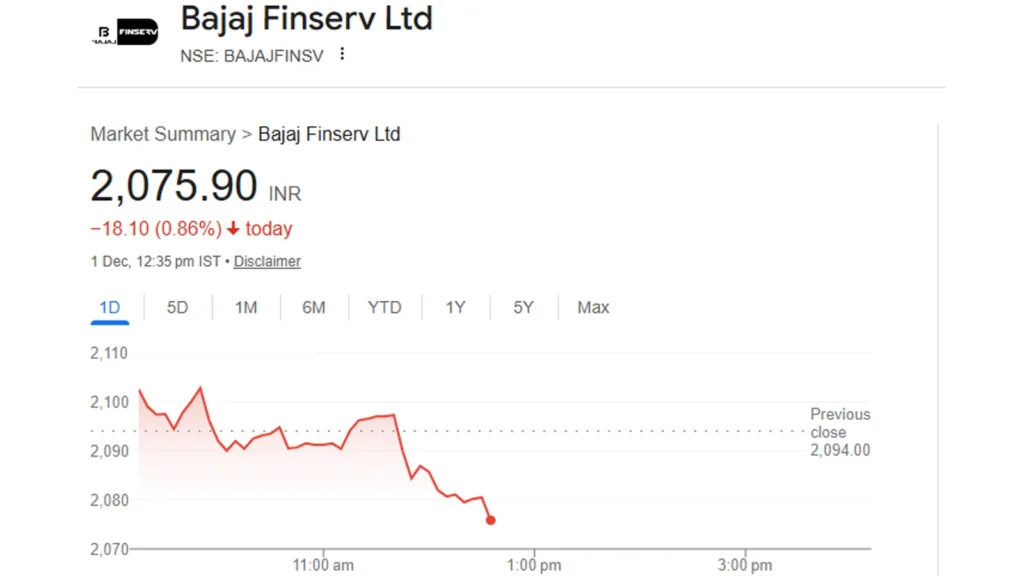

If you check the stock screen today — 1 December 2025 — you’ll see Bajaj Finserv at around ₹2,097 per share. That number reflects more than just a quote — it captures market sentiment, investor hopes, and a broader financial snapshot.

The buzz is real. This isn’t just another day for Bajaj Finserv. For many investors, it feels like the calm before the next big wave.

Bajaj Finserv Share Price Today: Sentiment Turns Brighter in 2025

The Indian stock market opened with a fresh wave of optimism today, and Bajaj Finserv instantly caught attention. Its share price moved with strong buying interest as investors reacted to improving market sentiment and expectations of solid financial performance ahead of Q3 FY26.

For many retail traders, Bajaj Finserv often behaves like a pulse of the financial services sector. And today’s movement once again reminded the market why this stock remains in focus.

Also Read Lenskart Share Price Rises After Strong Q2 FY26 Results

Bajaj Finserv Share Price Gains as Investors Turn Confident

The stock saw renewed activity during today’s session as financial counters witnessed broad-based positivity. Market participants said the movement signals early confidence ahead of upcoming quarterly updates.

Bajaj Finserv’s business model — spanning insurance, lending, and wealth management — gives it an edge during periods of market revival. When the broader sentiment improves, such diversified financial giants usually see quick inflows.

Retail traders tracking the Bajaj Finserv share price today noted that the stock held firm even during early volatility. This strength is often considered a healthy sign, especially when the Nifty Financial Services index also shows stability.

Why Bajaj Finserv Remains a Favourite in 2025

One of the biggest reasons investors love Bajaj Finserv is its strong track record of consistent growth.

The company’s lending arm has expanded aggressively. Its insurance business continues to gain market share. And wealth management is growing at a pace that reflects India’s rising financial awareness.

According to Mint, in 2025, when investors prefer stability mixed with growth, a conglomerate like Bajaj Finserv naturally attracts attention. As India’s consumption cycle strengthens and credit demand rises, financial sector players get a major push.

This trust factor is exactly what keeps Bajaj Finserv in the limelight.

Market Factors Driving Today’s Price Action

Several triggers contributed to the stock’s traction today.

Here are the ones market watchers highlighted:

1. Strong outlook for the NBFC sector in FY26

Analysts believe credit growth will continue to improve in FY26. NBFCs with diversified portfolios are expected to be the biggest beneficiaries. Bajaj Finserv fits that definition perfectly.

2. Expectations around Q3 FY26 earnings

The upcoming quarterly results have already built excitement. Investors are betting on strong income growth across all segments — especially consumer lending and insurance.

3. Rebound in domestic markets

After a slightly choppy November, markets have started December on a positive note. Financial stocks usually react first to such reversals.

4. Global cues supporting Asian markets

US and Asian markets showed stable signs, reducing fears among global investors. In 2025, any positive global cue immediately impacts Indian heavyweights.

These factors created a perfect setup for Bajaj Finserv’s upward movement today.

How Bajaj Finserv’s Businesses Look Heading Into 2026

If we break down the group’s businesses, the future looks encouraging:

Insurance

Life and general insurance penetration are rising rapidly in India. The new regulatory environment also supports long-term growth.

Lending

Consumer credit demand remains high. With digital-first operations, Bajaj’s lending platform continues to attract young customers.

Wealth & Investments

More Indians are switching from traditional savings to mutual funds, SIPs, and digital investment products. The wealth management unit is benefiting from this mindset shift.

In short, each business arm is riding on strong 2025–26 trends. This makes Bajaj Finserv one of the most balanced financial companies in the country.

Real-World Market Sentiment: What Investors Are Saying

Across social media and trading groups, traders are sharing a mix of excitement and caution.

Some expect the stock to move steadily as December progresses. Others believe the real momentum will come only after Q3 numbers are announced.

A retail trader commented in an online forum:

“Bajaj Finserv feels stable right now. I’m not expecting fireworks, but the stock looks prepared for a healthy upside if results meet expectations.”

This real-world sentiment shows a grounded confidence — not hype — which is exactly the tone of Indian markets in 2025.

Bajaj Finserv Share Price Outlook for December 2025

Based on the current market mood, analysts expect financial stocks to remain actively traded this month. Investors are also watching:

- Interest rate commentary

- RBI’s inflation estimates

- Credit demand data

- Insurance sector growth numbers

If these indicators stay positive, Bajaj Finserv may continue attracting steady buying.

But like any stock, short-term fluctuations will remain. Long-term investors, however, largely appear comfortable holding the stock given its stability and diversified revenue model.

Also Read Aequs IPO 2025: GMP, Price, Lot Size, Review & Full Details

My Take — Solid but Not for the Faint-Hearted

Bajaj Finserv feels like a seasoned marathon runner. It’s not flashy like a startup, but it has endurance. The current valuation seems fair, given its fundamentals.

If you ask me, I wouldn’t bet everything on a wild upside jump now. But for a steady-growth perspective, this stock offers a mix of reliability and realistic potential.

For those with patience and a long horizon, Bajaj Finserv can be a core portfolio holding.

Conclusion — Bajaj Finserv Remains a Key Player

Today’s performance shows that Bajaj Finserv continues to command trust among investors. As the market prepares for Q3 FY26 results, sentiment toward financial players is strengthening.

Bajaj Finserv today stands tall yet grounded. Its price, fundamentals, and recent performance show a company that refuses to be just another number on the ticker — it’s a major player in Indian finance.

If you’re investing for the long haul, it’s worth watching, and perhaps adding.

FAQs About Bajaj Finserv Share

1. Why did Bajaj Finserv shares rise today?

Ans.: Shares rose mainly due to improved market sentiment, expectations of strong Q3 FY26 performance across its lending and insurance businesses, and positive flows into financial stocks in early December 2025.

2. Is Bajaj Finserv a safe pick for 2025 investors?

Ans.: Many investors view Bajaj Finserv as a balanced pick because of its diversified businesses—lending, insurance and wealth management—which tend to offer stability during market upturns. However, short-term volatility can still occur, so assess risk tolerance before investing.

3. What key factors should I watch after today’s price move?

Ans.: Watch Q3 FY26 earnings, credit growth data, RBI monetary signals, and insurance sector updates—these will influence Bajaj Finserv’s near-term momentum and investor sentiment.

4. How does Bajaj Finserv benefit from rising credit demand?

Ans.: Rising credit demand boosts interest income for the lending arm and increases product uptake across consumer finance, which supports top-line growth and margins for the group.

5. Will global markets affect Bajaj Finserv’s share price?

Ans.: Yes. Positive global cues can lift risk appetite and flows into Indian financials, while global stress or rate shocks may cause short-term selling; domestic fundamentals still largely drive medium-term performance.

Also Read Meesho IPO on Dec 3: Key Details Investors Must Know

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies, not US News Weeks. We advise investors to check with certified experts before making any investment decisions.

Source : The Economic Times & Early Times - Bajaj Finserv Share

✍️ Written by Nikhil Singh

Market & IPO Analyst | Business News Writer | Tech-Auto Observer

Nikhil has been tracking Indian IPOs, consumer brands, tech & automobile overview, and financial trends since 2019. His writing style seamlessly blends market insight with a relatable human voice, making complex data accessible to everyday investors.